We discuss the outlook for UK equities.

Key points

- We believe UK equities still have a lot to offer.

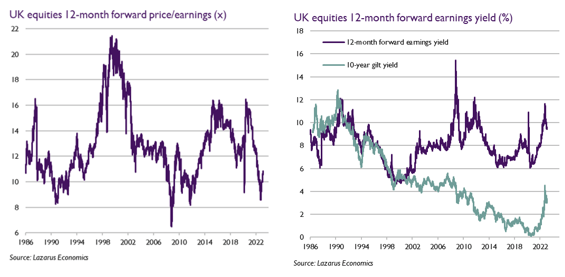

- Even weighed against a gloomy economic outlook, we find a 10% 12-month forward earnings yield compelling.

While some turbulence has recently returned to equity markets as a result of turmoil in the banking sector, UK stocks had started 2023 on a strong footing, with the FTSE All-Share Index reaching new all-time highs. This was despite an uncertain outlook with sticky inflation, negative GDP (gross domestic product) revisions, and companies guiding with caution. Against this backdrop, we remain optimistic for UK equities, and here we explain why.

The UK market has long traded at a discount to its global peers and, in fact, has underperformed the S&P 500 index by a staggering 60% and 230% on a five and 10-year basis respectively.1 While some of this underperformance may be explained by the slightly lower relative earnings profile of the UK market as well as the numerous political distractions (such as Brexit and last year’s mini-budget calamity), this does not fully explain the extent of the UK market’s underperformance over this period. At the time of writing, the FTSE All-Share Index trades at a near all-time low 10x price-to-earnings multiple.2 Even weighed against a gloomy economic outlook, we find a 10%3 12-month forward earnings yield compelling and, in our opinion, leaves scope for the FTSE All-Share to continue its advance.

Many UK companies generate a high proportion of their sales overseas

It is often said that the UK GDP outlook is one of the gloomiest in the developed world, but UK-listed companies can often grow independently of UK GDP. In fact, the majority of FTSE 100 and FTSE 250 company sales (c.82% and c.57% respectively) come from outside the UK,4 and we find the growth profiles of many companies are more dialled into structural drivers which are far longer-term in nature and so should be more resilient through the cycle. This includes exposure to the vibrant health-care sector, the ever-evolving shift to digitalisation and, increasingly, the demand to find more energy and environmentally efficient solutions.

Attractive UK dividend yield

The UK is often compared to the US, and it is the case that the sales-growth profile of UK companies can look lacklustre in comparison, particularly given the significant difference in technology stock exposure. However, generally UK companies tend to prioritise healthy margins over unprofitable sales growth which, as we come out of an extended period of ‘free money’, we believe could be seen more favourably. Companies which are well invested, with minimal capital intensity and the ability to generate sustainably high returns and cash flow should attract investors. Companies of this type are typically able to pay out a greater quantum of excess cash to shareholders while still maintaining healthy balance sheets, something which is reflected in the more attractive UK dividend yield.

As active managers with a bottom-up stock-picking approach, we can select companies with the most attractive growth prospects, highest quality attributes and most compelling valuations. The high weighting of more ‘conventional’ and cyclical businesses such as banks and commodities often distorts the perception of quality within the UK, but our ability to invest differently from the benchmark means we select those companies that we believe have the best chance of generating strong returns in future.

It is this combination of sustainable earnings growth, with limited correlation to GDP, discounted valuations relative to global peers and a higher focus on earnings and cash flow that gives us a positive outlook for UK equities and makes us believe the asset class still has a lot to offer.

Sources:

- Bloomberg, 20/2/2013 –17/02/2023, 20/02/2018 – 17/2/2023

- Lazarus Economics

- Lazarus Economics

- FTSE Russell https://www.ftserussell.com/blogs/overseas-revenues-boon-ftse-100-performance

This is a financial promotion. These opinions should not be construed as investment or other advice and are subject to change. This material is for information purposes only. This material is for professional investors only. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell investments in those securities, countries or sectors. Please note that holdings and positioning are subject to change without notice.

Comments