Against a diverse emerging-market backdrop, we use themes to identify globally important, observable forces of long-term change that we believe can influence our investible universe. In the second of a short series of posts exploring key themes that play a role in helping us to select our emerging-market investments, we look at ‘Earth matters’.

Earth matters has been a core theme at Newton for many years, owing to our recognition that rapidly increasingly levels of economic activity across the globe have created significant stress on the world’s environmental resources, and we have sought to evaluate the resulting investment opportunities and risks. Currently, there seems to have been something of a convergence of both pressure and intent among individuals, businesses and governments to ignite action in this area.

This theme covers a wide scope of environmental threats, including climate change, pollution and resource depletion, while considering the opportunities inherent in the development of clean technologies and innovation across a range of industries to help build the necessary safeguards. It also analyses cost and affordability constraints, even with rapid technological advances, as well as the growing risks of non-compliance with laws in both financial and reputational terms.

The biggest investment opportunity we see in this area from an emerging-market, and possibly global, perspective is driven by the nascent electric-vehicle (EV) revolution. The automobile industry globally is currently being affected by policies on fuel economy, climate change, and air pollution. EVs look well placed for dramatic growth, but costs will have to fall as subsidies are removed. We expect EVs to reach cost parity with combustion vehicles by 2021, as battery pack costs decrease to $100 per kilowatt hour (kWh), from $1,000 per kWh in 2010. This should create an inflection in demand, such as has been witnessed historically in the adoption trends of many compelling consumer technologies, which scale their penetration faster than is anticipated.

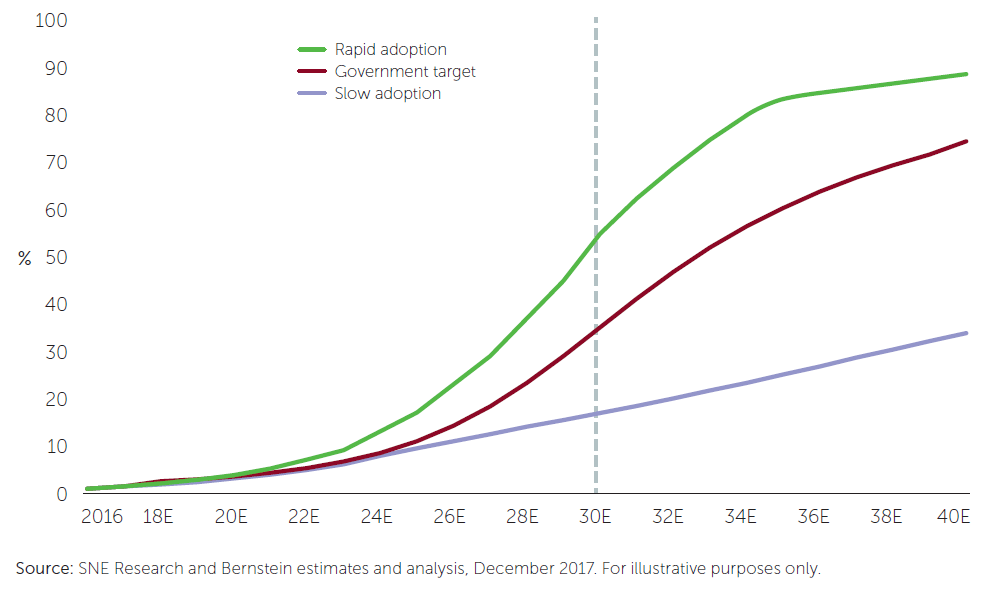

Three potential rates for battery electric vehicle (BEV) and plug-in hybrid electric vehicle (PHEV) adoption as a percentage of car shipments globally. By 2030 we project 55% for ‘rapid adoption’, 35% for ‘government target scenario’ and 17% for ‘slow adoption’

Financial-market participants generally remain far more cautious about this demand outlook, and provides us with a point of differentiation. We believe demand is supported not only by policy and pricing, but by the fact that EVs are ultimately better products. Tesla has done a lot for the credibility of EVs in consumer perception, but EVs also have higher instant torque, are more reliable and safer, and have lower maintenance costs and no engine noise! We believe that both battery manufacturers and lithium producers are very well positioned to create value from what is set to be a long-term trend.

Multi-year growth opportunity

In 2017, the number of EVs globally increased from 740,000 to 1.1 million. Pure EVs grew at 61%, while hybrids grew at 36%. We expect EV penetration to rise from 2% to 10% of new car sales by 2025. In our view, the market is currently erroneously over-focused on near-term supply, when the key issue is long-term demand. It is instructive to see that incumbent auto original equipment manufacturers (OEMs) are all now on board, launching products into the market by 2020, and securing their lithium supplies. The European Union has announced that steep fines will be imposed on those not meeting their 2020 targets to reduce carbon emissions to 95 grams per kilometre. To achieve this, almost all manufacturers need to improve their emissions by 20 grams per kilometre and more. That is almost impossible with conventional power trains (the main components that generate power in vehicles).

We know that this is still very much a nascent industry, with a number of continuing challenges, such as insufficient charging infrastructure, mass-market models still being subject to ‘range anxiety’, and affordability. Further technological advancement of batteries is coming, and costs will fall as battery capacity increases. We do not expect straight-line progress, as the early-stage industry scales to multiples of its current size, but we are excited about identifying the right investments to capture the value of this high multi-year growth opportunity.

This is a financial promotion. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell investments in those countries or sectors. Please note that holdings and positioning are subject to change without notice. Compared to more established economies, the value of investments in emerging markets may be subject to greater volatility, owing to differences in generally accepted accounting principles or from economic, political instability or less developed market practices.

Comments