Falling amid the continuing drama of Brexit negotiations, expectations for excitement from the British Chancellor of the Exchequer Philip Hammond’s spring Budget statement yesterday were low, and Mr. Hammond met those low expectations.

Despite Brexit uncertainty, the UK government’s Office for Budget Responsibility’s (OBR) forecasts for the UK’s economic growth over the next five years as a whole were slightly more rosy than in October. More immediately, however, growth in the UK’s current fiscal year was revised down from 1.6% to 1.2%.

Although growth has been weaker than expected, two other factors have also allowed UK borrowing to undershoot forecasts: higher tax receipts and lower borrowing costs than forecast. Moreover, the OBR is assuming (without too much explanation) that these tailwinds will persist.

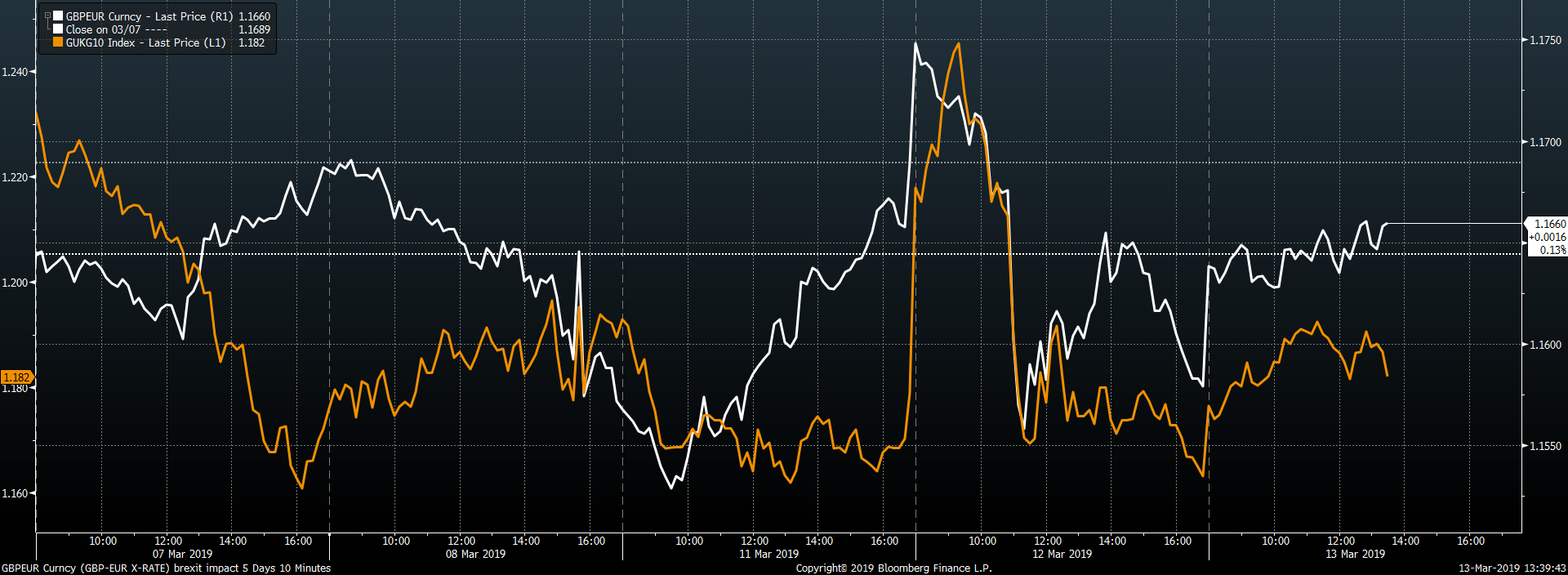

The statement certainly wasn’t market-moving. The graph below shows the sterling/euro exchange rate (white line), and 10-year gilt yields (orange line) over the last five trading days. Hopes and fears around Brexit engendered significant volatility earlier in the week, but markets hardly moved as the chancellor spoke.

Source: Bloomberg, March 13 2019

The autumn Budget should be more interesting, with a three-year departmental spending review completed by then as well as a national infrastructure policy. Both of these could presage a further loosening of the UK’s fiscal purse strings.

All Eyes on Brexit

However, in the near term, Brexit is far more important. After ‘Groundhog May’ (the second parliamentary defeat for Prime Minister Theresa May’s Brexit deal) on Tuesday (March 12), and the parliamentary vote to rule out the UK leaving the EU with no deal yesterday (March 13), the UK parliament is set to vote on whether to seek an extension of the Brexit process beyond March 29, the date at which the UK is officially supposed to leave the EU.

The depressing fact is that the number of possible outcomes is rising, not falling, and none is highly likely. The whole process of predicting the Brexit end game has gone from a flow-chart process which clearly maps out the probabilities of different outcomes, to something more akin to the children’s ‘paper fortune’ origami game, where a whole range of outcomes are possible but none are certain.

This makes things difficult from an investment perspective. Faced with a high-probability central scenario and tail risks, you can position for the most likely outcome and hedge the tail risks. With multiple outcomes all less than 50% likely, it is much harder to take an active view or position. This perhaps explains why neither UK gilts nor sterling are breaking out decisively one way or another. A ‘hard Brexit’ is likely to be very sterling-negative and gilt-positive in the short term at least, while a ‘softer’ or ‘no-deal’ Brexit would have the opposite effect.

Extension on the Way?

A request for an extension to Article 50 looks inevitable, but the EU will rightly want to know what a delay is intended to achieve (a so-called ‘reasoned request’). Accordingly, uncertainty and volatility are likely to persist for a few months more at least.

For our part, we have felt it prudent for the last several weeks to be neutral sterling, with a short gilt bias. The reasoning for the latter is that, of the many Brexit-related (and political change) potential outcomes, a higher proportion could result in higher yields. Despite appearances to the contrary, we do not think Theresa May’s deal is dead: at this point, it remains the only deal on the table, however imperfect. Meanwhile, pressure to achieve a deal as the clock runs down towards March 29 may leave resistant UK politicians with no choice but to look beyond its imperfections, and to compromise.

This is a financial promotion. Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. You should consult your advisor to determine whether any particular investment strategy is appropriate. This material is for institutional investors only. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice. ‘Newton’ and/or the “Newton Investment Management” brand refers to the following group of affiliated companies: Newton Investment Management Limited and Newton Investment Management (North America) Limited (NIMNA Ltd). In the UK, NIMNA Ltd is authorized and regulated by the Financial Conduct Authority in the conduct of investment business and is a wholly owned subsidiary of The Bank of New York Mellon Corporation. Registered in England no. 2675952. NIMNA Ltd is registered with the SEC as an investment adviser under the Investment Advisers Act of 1940. NIMNA Ltd’s investment business is described in Form ADV, Part 1 and 2, which can be obtained from the SEC.gov website or obtained upon request. Personnel of certain of our BNY Mellon affiliates may act as: (i) registered representatives of MBSC Securities Corporation (in its capacity as a registered broker-dealer) to offer securities, (ii) officers of the Bank of New York Mellon (a New York chartered bank) to offer bank-maintained collective investment funds, and (iii) Associated Persons of MBSC Securities Corporation (in its capacity as a registered investment adviser) to offer separately managed accounts managed by BNY Mellon Investment Management firms, including NIMNA Ltd. Certain information contained herein is based on outside sources believed to be reliable, but their accuracy is not guaranteed. Unless you are notified to the contrary, the products and services mentioned are not insured by the FDIC (or by any governmental entity) and are not guaranteed by or obligations of The Bank of New York or any of its affiliates. The Bank of New York assumes no responsibility for the accuracy or completeness of the above data and disclaims all expressed or implied warranties in connection therewith. © 2006 The Bank of New York Company, Inc. All rights reserved.

Important information

This is a financial promotion. Issued by Newton Investment Management Limited, The Bank of New York Mellon Centre, 160 Queen Victoria Street, London, EC4V 4LA. Newton Investment Management Limited is authorized and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN and is a subsidiary of The Bank of New York Mellon Corporation. 'Newton' and/or 'Newton Investment Management' brand refers to Newton Investment Management Limited. Newton is registered in England No. 01371973. VAT registration number GB: 577 7181 95. Newton is registered with the SEC as an investment adviser under the Investment Advisers Act of 1940. Newton's investment business is described in Form ADV, Part 1 and 2, which can be obtained from the SEC.gov website or obtained upon request. Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. You should consult your advisor to determine whether any particular investment strategy is appropriate. This material is for institutional investors only.

Personnel of certain of our BNY Mellon affiliates may act as: (i) registered representatives of BNY Mellon Securities Corporation (in its capacity as a registered broker-dealer) to offer securities, (ii) officers of the Bank of New York Mellon (a New York chartered bank) to offer bank-maintained collective investment funds, and (iii) Associated Persons of BNY Mellon Securities Corporation (in its capacity as a registered investment adviser) to offer separately managed accounts managed by BNY Mellon Investment Management firms, including Newton and (iv) representatives of Newton Americas, a Division of BNY Mellon Securities Corporation, U.S. Distributor of Newton Investment Management Limited.

Unless you are notified to the contrary, the products and services mentioned are not insured by the FDIC (or by any governmental entity) and are not guaranteed by or obligations of The Bank of New York or any of its affiliates. The Bank of New York assumes no responsibility for the accuracy or completeness of the above data and disclaims all expressed or implied warranties in connection therewith. © 2020 The Bank of New York Company, Inc. All rights reserved.