With the UK general election result imminent, it is worth reminding ourselves what impact an outright Labour or Conservative victory would have on the UK government-bond (gilts) market if the respective party manifesto spending pledges are honoured.

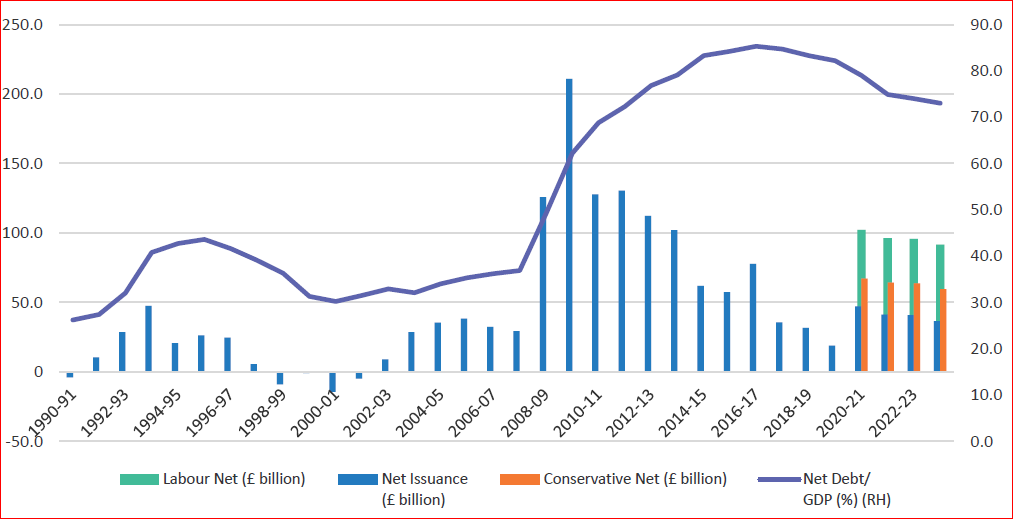

The chart below shows the following data: historic and forecast net gilt issuance as per the UK Debt Management Office’s (DMO) latest forecasts (vertical blue bars); the debt/GDP percentage ratio derived from this data (purple line); and the approximate impact of both parties’ manifesto pledges (Conservative orange bars, Labour green bars), taken at face value. Both would imply a modest uptick in the debt/GDP ratio, with the potentially bigger boost to GDP from Labour’s plans offset by more debt.

Gilt Issuance and Debt GDP Ratio

Source: DMO (historic and estimated data), Newton, November 2019

Left-hand axis denotes billions (£), right-hand axis denotes UK net debt/GDP (%)

At first glance you might think neither plan poses particular challenges for the gilt market to absorb; even under Labour’s plans, net issuance would only be at or below the average for the first half of this decade, and well below the post-financial crisis peak.

New Tax Revenues

In essence, both parties claim they can fund the increase in current spending from new tax revenues. The Conservatives are earmarking an extra £20bn a year for capital investment, while Labour is planning closer to £55bn of extra capital spending. However, a closer look reveals big differences in the assumptions on changes in current spending and tax revenue.

Under the Conservative plans, current spending and tax revenues are each about £3bn higher than previous budget forecasts (with most of the extra tax-take coming from cancelling a planned further cut in corporation tax rates from the next fiscal year). The problem with this approach is that by ruling out any increases in the three main personal taxes (income tax, national insurance and value-added tax), the party has closed off one financing avenue if greater public spending is needed for, say, the National Health Service (NHS), or if pursuit of a clean break with the European Union (EU) at the end of 2020 leads to further economic weakness. Extra borrowing would therefore be required to plug the gap.

However, under Labour’s plans, spending would be £83bn higher than current Office for Budget Responsibility (OBR) forecasts, with the intention being to fund this via higher tax revenues from the top 5% of earners and from companies. This is quite a narrow base from which to attempt to raise a considerable amount of tax. Risks revolve around whether raising income taxes on the few will actually increase or decrease the total tax take.

Conservatives would point to the effects of Labour’s higher-rate tax increases immediately after the financial crisis, and Conservative cuts after 2010, as ‘evidence’ that higher tax rates may generate less, rather than more, revenue. It is also open to debate whether tax receipts from companies will hold up in the face of a likely squeeze on profits from a large increase in labour costs (‘real living wage’) and other potentially less ‘business-friendly’ policies. At 26% – Labour’s ultimate target – UK company tax rates would be among the highest of any major economy (except the US at 27%), making it potentially less attractive as a tax domicile, especially when allied with other policies around employee (and state) ownership.

Heightened Risks for Gilts

Whatever the political, social or economic merits of a larger role for the state, it seems clear that under either leadership, the risks in terms of extra government borrowing (and consequently gilt supply) are certainly elevated.

Credit rating agencies will have limited patience with any further fiscal slippage, given that two of the major three already have their rating of the UK on negative outlook, and the third, Fitch, already has the rating on review for downgrade. However, given that markets are pricing in a Conservative victory, and Labour’s plans involve more execution risk as well as more borrowing, victory for the latter party is likely to cause far greater volatility in the gilt market.

Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice.

Important information

This is a financial promotion. Issued by Newton Investment Management Limited, The Bank of New York Mellon Centre, 160 Queen Victoria Street, London, EC4V 4LA. Newton Investment Management Limited is authorized and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN and is a subsidiary of The Bank of New York Mellon Corporation. 'Newton' and/or 'Newton Investment Management' brand refers to Newton Investment Management Limited. Newton is registered in England No. 01371973. VAT registration number GB: 577 7181 95. Newton is registered with the SEC as an investment adviser under the Investment Advisers Act of 1940. Newton's investment business is described in Form ADV, Part 1 and 2, which can be obtained from the SEC.gov website or obtained upon request. Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. You should consult your advisor to determine whether any particular investment strategy is appropriate. This material is for institutional investors only.

Personnel of certain of our BNY Mellon affiliates may act as: (i) registered representatives of BNY Mellon Securities Corporation (in its capacity as a registered broker-dealer) to offer securities, (ii) officers of the Bank of New York Mellon (a New York chartered bank) to offer bank-maintained collective investment funds, and (iii) Associated Persons of BNY Mellon Securities Corporation (in its capacity as a registered investment adviser) to offer separately managed accounts managed by BNY Mellon Investment Management firms, including Newton and (iv) representatives of Newton Americas, a Division of BNY Mellon Securities Corporation, U.S. Distributor of Newton Investment Management Limited.

Unless you are notified to the contrary, the products and services mentioned are not insured by the FDIC (or by any governmental entity) and are not guaranteed by or obligations of The Bank of New York or any of its affiliates. The Bank of New York assumes no responsibility for the accuracy or completeness of the above data and disclaims all expressed or implied warranties in connection therewith. © 2020 The Bank of New York Company, Inc. All rights reserved.