Key Points

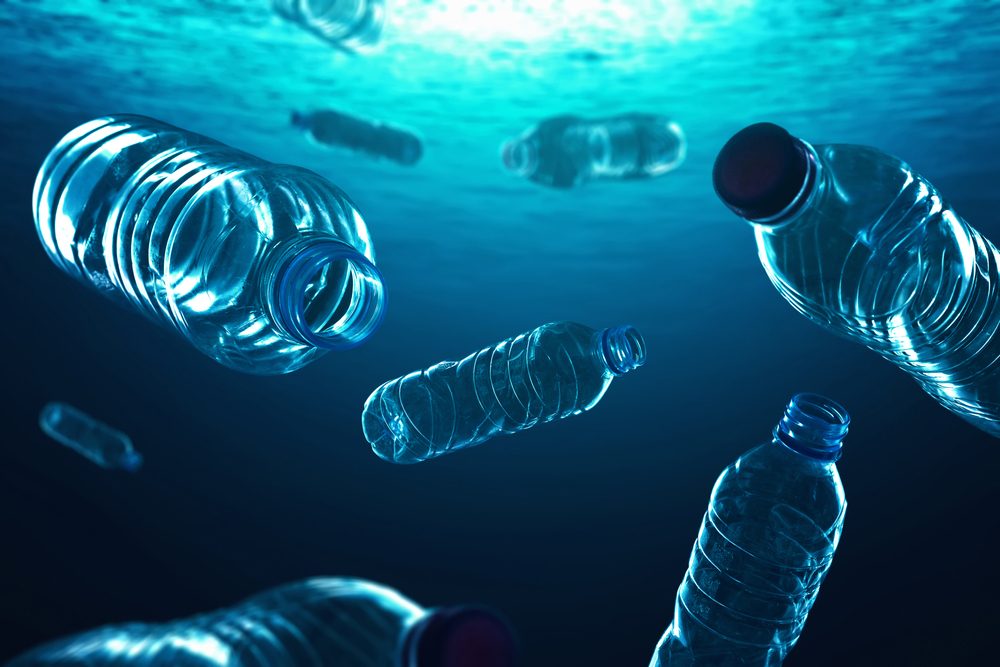

- This month has been designated ‘Plastic Free July’ to turn the spotlight on the issue of plastic and packaging pollution.

- It is estimated that around 80% of all marine debris is made up of plastic waste.

- Some 32% of globally produced plastics escape collection, while only 14% of plastic packaging is recycled for future use.

- Governments are increasingly implementing regulation to encourage more sustainable solutions for plastic production and disposal.

This month has been designated ‘Plastic Free July’ by global not-for-profit group Plastic Free Foundation,1 so it seems an appropriate time to examine the impact of plastics upon our world, and the steps that are being taken to combat this serious environmental problem.

Plastics and packaging have become a poster child for environmental pollution and neglect over the last few years, and there has been a consumer backlash against plastic and packaging excess. Most consumer goods companies have a target to shift towards recycled, reused or composted plastic, with many aiming for 100% by 2025, but a report by the Ellen MacArthur Foundation suggests these targets are not likely to be achieved.2 Some companies have also been quietly lengthening time frames for targets.

In the UK alone, plastic packaging makes up around 70% of all plastic waste.3 Plastic’s durable nature results in the production of microplastics, which often build up in waterways, and subsequently enter the food chain, harming local ecosystems and biodiversity. The stark scale of the problem is highlighted by the fact that an estimated 80% of all marine debris is made up of plastic waste.4

Growing Regulation

Other than the obvious damaging environmental consequences, companies that rely heavily on plastic remain exposed to reputational risk, reduced consumer engagement with their products, and the threat of regulatory fines. In addition, companies face potential operational changes, such as having to shift suppliers, change packaging and adjust operations to account for bans. For example, the UK government announced earlier this year that single-use plastic plates, bowls, forks and knives will be banned from sale in the UK from October 2023.

In Europe, the European Union’s Circular Economy Plan has created specific proposals to tackle plastics and packaging, which focus on reducing waste, improving recyclability, and addressing the issue of microplastics. Moreover, regulation is increasingly coming into play, with extended producer responsibility laws being introduced, thus creating liability for producers in relation to the use of products even after they have been sold to consumers, and encouraging management of environmental impact across the full life cycle. Packaging is a key focus of these laws, given its prevalence and single-use nature; however, they also touch on other areas associated with microplastics such as apparel and tires, as well as consumer waste (including from technology and white goods).

In addition, in April, CDP (formerly the Carbon Disclosure Project), which runs a disclosure system for organizations to manage their environmental impacts, launched its disclosure on plastic-related impacts, with companies asked to disclose on the most problematic plastic production and use, including plastic polymers, durable plastics and plastic packaging. Sectors with a high impact that have been invited to disclose include chemicals, fashion/apparel materials, food and beverage, fossil fuels, and packaging.

Habits are changing at the personal level too. Global consultancy Toluna conducted research on 5,900 European consumers in 2020, which revealed that 70% are actively taking steps to reduce their use of plastic packaging.5

Bioplastic Resurgence

There are two main types of bioplastics that can be broken down: the first is produced from agricultural feedstock as opposed to oil, while the second type is designed to be biodegradable after use. The former, known as bio-based plastics, may help to reduce life-cycle carbon emissions, while the latter – biodegradable plastic – can address the ever-growing issue of plastic waste. However, it should be noted that some biodegradable options can only break down in industrial facilities, and they often do not end up reaching these facilities owing to infrastructure challenges that exist with recycling (collection, sorting and processing). This could represent a reputational risk, as this is not always understood.

Investment Opportunities

There is no one solution to addressing the extent of plastic and packaging waste, nor to reaching net-zero carbon emissions. As such, we look at a range of potential solutions to reducing plastic and packaging waste for investment opportunities, in addition to potential infrastructure plays (e.g. reverse vending machines). Some alternative materials that we think about include:

- Recycling: Some 32% of globally produced plastics escape collection, while only 14% of plastic packaging is recycled for future use.6

- Paper: Paper is suitable for replacing plastic across several key items: films and wraps; rigid plastic packaging; sachets and multilayer film; pots, tubs and trays; and disposable food containers.

- Bio-based Plastics: Around 6% of fossil-fuel demand is for plastic production, and on current estimates, that is set to grow to 20% by 2050.7 The growth of bioplastics offers a potential alternative and may also offer lower life-cycle carbon emissions over time.

- Biodegradable Plastics: These are a suitable solution for food packaging, so that leftovers and packaging can be composted together. In 2022, 48% of biodegradable plastic demand was for packaging.8

Innovation in Private Markets

According to data from Pitchbook, venture capital investment in the sustainable packaging industry peaked in 2021, totaling $834m raised for the year across 87 deals.9 Companies are investing in research and development to drive advancements in materials science and manufacturing processes with the goal of achieving price parity and scalability in the near future. While current alternatives to traditional plastics in the packaging sector have not generally achieved price parity, companies are actively exploring a myriad of options to develop substitutes for petroleum-based resin pellets and powders that can be seamlessly integrated into existing production and hardware processes.

Innovative approaches to sustainable packaging include using seaweed and algae to create bioplastics, harnessing mycelium as a basis for plastic alternatives, and exploring the use of hay pellets to produce grass paper. Moreover, companies are actively developing sustainable coatings that can be applied to various materials, imbuing them with the beneficial properties of plastics while ensuring they can be easily recycled or composted.

In addition to seeking alternatives, some companies are focused on developing additives to mitigate the less sustainable aspects of plastics, rather than replacing them entirely or partially. Although this field is still in its early stages, companies are diligently working to devise solutions, such as developing enzymes that expedite the breakdown of plastic.

Challenges to Be Overcome

As investors, we are mindful that there are technical challenges associated with plastic recycling, and that there are limits to the amount of times that plastic can be recycled. Despite a multitude of commitments and pledges, relatively few companies have yet disclosed how much they will invest in packaging innovation and the shift from virgin to recycled plastic. Many biodegradable plastics also require industrial composting, which can create challenges around collection, but we are hopeful that the increased consumer focus on this area, combined with technological innovation and helpful regulation, will ultimately help to reduce the impact of plastic and packaging pollution on our planet.

Sources:

- https://www.plasticfreejuly.org/

- Ellen MacArthur Foundation, The Global Commitment 2022 Progress Report, 2022.

- The Waste and Resources Action Programme, Plastic Packaging, accessed June 29, 2023: https://wrap.org.uk/taking-action/plastic-packaging

- International Union for Conservation of Nature, Issues brief – Marine plastic pollution, November 2021.

- Two Sides, European Packaging Preferences 2020, accessed June 29, 2023: https://www.twosides.info/documents/research/2020/packaging/European-Packaging-Preferences-2020_EN.pdf

- World Economic Forum. The New Plastics Economy – Rethinking the future of plastics. January 2016.

- Ibid.

- European Bioplastics, Applications for bioplastics, accessed June 29, 2023: https://www.european-bioplastics.org/market/applications-sectors/

- PitchBook, PitchBook Analyst Note: Unwrapping Sustainable Packaging, October 20, 2022.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice. Newton manages a variety of investment strategies. How ESG considerations are assessed or integrated into Newton’s strategies depends on the asset classes and/or the particular strategy involved. ESG may not be considered for each individual investment and, where ESG is considered, other attributes of an investment may outweigh ESG considerations when making investment decisions. ESG considerations do not form part of the research process for Newton's small cap and multi-asset solutions strategies. For additional Important Information, click on the link below.

Important information

For Institutional Clients Only. Issued by Newton Investment Management North America LLC ("NIMNA" or the "Firm"). NIMNA is a registered investment adviser with the US Securities and Exchange Commission ("SEC") and subsidiary of The Bank of New York Mellon Corporation ("BNY Mellon"). The Firm was established in 2021, comprised of equity and multi-asset teams from an affiliate, Mellon Investments Corporation. The Firm is part of the group of affiliated companies that individually or collectively provide investment advisory services under the brand "Newton" or "Newton Investment Management". Newton currently includes NIMNA and Newton Investment Management Ltd ("NIM") and Newton Investment Management Japan Limited ("NIMJ").

Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed.

Statements are current as of the date of the material only. Any forward-looking statements speak only as of the date they are made, and are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking statements. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment and past performance is no indication of future performance.

Information about the indices shown here is provided to allow for comparison of the performance of the strategy to that of certain well-known and widely recognized indices. There is no representation that such index is an appropriate benchmark for such comparison.

This material (or any portion thereof) may not be copied or distributed without Newton’s prior written approval.

In Canada, NIMNA is availing itself of the International Adviser Exemption (IAE) in the following Provinces: Alberta, British Columbia, Manitoba and Ontario and the foreign commodity trading advisor exemption in Ontario. The IAE is in compliance with National Instrument 31-103, Registration Requirements, Exemptions and Ongoing Registrant Obligations.