Key Points

- Given that corporate disclosures on biodiversity tend to be limited, we believe dialogue with investee companies is likely to be a valuable tool for investors.

- We expect industry engagements on biodiversity to become more targeted and sophisticated over time, as investors’ understanding of the risks increases, regulations emerge, and the financial impacts of biodiversity on investee companies become clearer.

- Public policy, governments and supranational organizations will all have a key role to play in addressing biodiversity outcomes.

Stewardship

In early 2021, we identified biodiversity as a priority engagement topic. The collapse in biodiversity poses a material risk to companies across a range of industries, as well as at a systemic level, yet the corporate world’s understanding of its relationship with biodiversity is still nascent relative to other environmental issues. As investors, we have a duty to understand a company’s impact on biodiversity. Given that corporate disclosures tend to be limited on this subject, we believe dialogue with investee companies is likely to be a valuable tool for investors. This can encourage a greater understanding of biodiversity as an investment risk, as well as enable the collection of data to inform business decision-making, alongside the monitoring of progress.

Our stewardship efforts around biodiversity have in the past focused on specific components such as deforestation, particularly concentrating on palm oil or soy supply chains. We have also participated in more specialized undertakings, such as with the Farm Animal Investment Risk and Return (FAIRR) initiative. We took part in FAIRR’s sustainable aquaculture engagement, which sought to understand and encourage movement away from fish meal and fish oil to innovative feedstocks within farmed fishing, and we also contributed to its efforts related to the transition from traditional meat to plant-based foods and alternatives. Such engagements, whether direct or collaborative, have helped us build internal technical expertise which enables us to be detailed and nuanced, and therefore credible, when speaking with companies on this issue.

Industry engagements on biodiversity have often been sporadic or focused on singular issues, as illustrated by the examples above. We expect engagement to become more targeted and sophisticated over time, with more tangible expectations, as investors’ understanding of these risks increases, regulations emerge, and the ways in which biodiversity has a financial impact on investee companies become clearer.

Policy and Sovereign Engagement

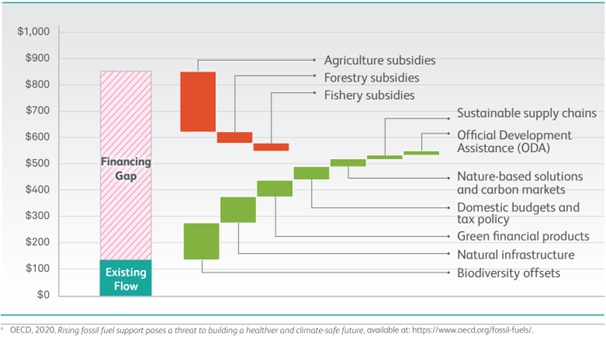

More funding is required in order to protect and mitigate the loss of biodiversity, and this will not come from the private sphere alone. Public policy, governments and supranational organizations have a significant role to play in closing this financing gap, as evidenced by the targets of the United Nations’ Sustainable Development Goals. As investors, we must consider not only how we develop our understanding of this systemic risk and integrate it into investment decisions, but also how we deploy our stewardship efforts to address the risk, by engaging with companies, collaborating across stakeholder groups or opining on public policy developments.

Estimate of Growth in Financing Resulting from Scaling up Proposed Mechanisms by 2030 (in 2019 US$ Billion per Year)

A key policy commitment in this area is the Convention on Biological Diversity (CBD), which has been ratified by almost 200 countries since 1992, and which is governed by the Conference of the Parties (COP). The most recent Conference of the Parties (COP 15 in Montreal) adopted the Kunming-Montreal Global Biodiversity Framework, which sets out four goals for 2050 and 23 targets for 2030. We think most significant are the targets for 30% of land and ocean ecosystems to be effectively conserved and 30% of degraded ecosystems to be under effective restoration programs by 2030. These are colloquially known as ‘30 by 30’. However, we may want to reserve some skepticism for this success as prior biodiversity targets have existed at country level but have not been achieved.

The historical challenges on the investment side have involved not knowing the full extent of the impact that investment activities can have on local communities and how they overlap with areas of high biodiversity. Companies have not been required to report on this, but now with satellite data combined with reported data from companies, there is far more transparency as to where companies are operating, including through joint ventures, and how proximate this is to biodiversity-rich or protected sites. Effective stewardship around this may include engaging with policymakers, non-governmental organizations (NGO) and potentially even sovereigns.

However, when encouraging progress on such topics, investors need to be aware of unintended consequences, for instance those that occurred as a result of the investment industry’s engagements on sustainable aquaculture. When encouraging the move away from fishmeal, companies ended up moving to soy feed, which shifted the risk from one biodiversity impact – the use of fish to feed fish – to another – deforestation risk. This illustrates the importance of understanding the impact of different scenarios.

We are also seeing increasing demand from companies, NGOs and specialist groups to have joined-up conversations, demonstrated by the FAIRR thought-leadership round table on alternative protein reporting1 and the Investor Coalition on Food Policy, through which investors, companies and NGOs contribute to government consultations on environmental and social issues. Interestingly, we are even seeing this pressure come from companies themselves, such as the letter from UK food retailers to politicians in the Brazilian National Congress around deforestation.2 As companies seek to meet their own targets, it requires progress within their value chain too, which can also drive significant change.

Finally, and particularly importantly, many environmental and social issues are externalities. They pose risks to companies, and have impacts on stakeholders, such as customers or the environment, but they may not be fully or consistently financially material. Moreover, the ways in which they are financially material may be poorly understood. Regulation is one key mechanism by which these issues can become financially material, which, in turn, can lead companies to address them. With this in mind, we think policy and sovereign engagements are crucial in ensuring investors can engage for real-world outcomes and have the leverage to engage with companies.

What Is Newton Doing?

Biodiversity remains one of our priority engagement themes, and Newton is pleased to have joined the Taskforce on Nature-related Financial Disclosures (TNFD) Forum. The TNFD is developing a disclosure framework to aid companies in how they report and act on evolving nature-related risks, with the ultimate aim of supporting a shift in global financial flows away from nature-negative outcomes and towards nature-positive outcomes. The final framework will be published in September. The TNFD Forum is a global consultative group of institutions and, at present, consists of over 1,000 members, including Newton. As a member of the forum, we are able to join TNFD updates and stay informed on how proposals and requirements develop. This is important for us as we develop a framework for considering biodiversity risks, so that we understand the latest thinking and can evolve to meet expectations.

Sources:

- FAIRR.org, Alternative Proteins Framework. Accessed May 31, 2023: https://www.fairr.org/research/alternative-proteins-framework/

- BBC.com, UK supermarkets warn Brazil over Amazon land bill, May 5, 2021.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice. Newton manages a variety of investment strategies. How ESG considerations are assessed or integrated into Newton’s strategies depends on the asset classes and/or the particular strategy involved. ESG may not be considered for each individual investment and, where ESG is considered, other attributes of an investment may outweigh ESG considerations when making investment decisions. ESG considerations do not form part of the research process for Newton's small cap and multi-asset solutions strategies. For additional Important Information, click on the link below.

Important information

For Institutional Clients Only. Issued by Newton Investment Management North America LLC ("NIMNA" or the "Firm"). NIMNA is a registered investment adviser with the US Securities and Exchange Commission ("SEC") and subsidiary of The Bank of New York Mellon Corporation ("BNY Mellon"). The Firm was established in 2021, comprised of equity and multi-asset teams from an affiliate, Mellon Investments Corporation. The Firm is part of the group of affiliated companies that individually or collectively provide investment advisory services under the brand "Newton" or "Newton Investment Management". Newton currently includes NIMNA and Newton Investment Management Ltd ("NIM") and Newton Investment Management Japan Limited ("NIMJ").

Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed.

Statements are current as of the date of the material only. Any forward-looking statements speak only as of the date they are made, and are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking statements. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment and past performance is no indication of future performance.

Information about the indices shown here is provided to allow for comparison of the performance of the strategy to that of certain well-known and widely recognized indices. There is no representation that such index is an appropriate benchmark for such comparison.

This material (or any portion thereof) may not be copied or distributed without Newton’s prior written approval.

In Canada, NIMNA is availing itself of the International Adviser Exemption (IAE) in the following Provinces: Alberta, British Columbia, Manitoba and Ontario and the foreign commodity trading advisor exemption in Ontario. The IAE is in compliance with National Instrument 31-103, Registration Requirements, Exemptions and Ongoing Registrant Obligations.