Key points

- Former army general Prabowo Subianto looks likely to be the next Indonesian president, but all three candidates have pledged to continue many of the effective economic and social reform policies initiated by incumbent Joko Widodo.

- Indonesia’s GDP per capita has almost doubled over the last decade despite several years of Covid disruption.

- Quarterly inward foreign direct investment has increased from a run rate of $2-3bn to around $5-6bn over the same period.

- We believe a Prabowo victory may represent the strongest possible growth outlook for Indonesia but could also come with higher ESG and/or foreign policy risks attached.

- We remain constructive on the macroeconomic outlook for Indonesia and believe emerging-market investors should consider being overweight the country owing to its superior economic growth potential and convergence with upper-middle income economies.

With Indonesia’s presidential and legislative elections taking place on 14 February, we met Indonesia’s ambassador to Singapore to discuss the country’s macro-political dynamics and outlook for the investment landscape over the next five years.

Building on the Jokowi legacy

As the three presidential candidates, Prabowo Subianto, Ganjar Pranowo and Anies Baswedan, vie for the presidency this week, the overarching message from each is ‘continuity’. As of polling day on 14 February, Prabowo appears to be the overwhelming favourite to win the contest, but it could take several more days for the official result to be announced.

There are naturally some policy differences and nuances, but the fact that all three candidates are pledging to build on the infrastructure, social-development, inward-investment and down-streaming policies implemented over President Joko Widodo’s two terms in office is a strong endorsement of the incumbent president and his successes.

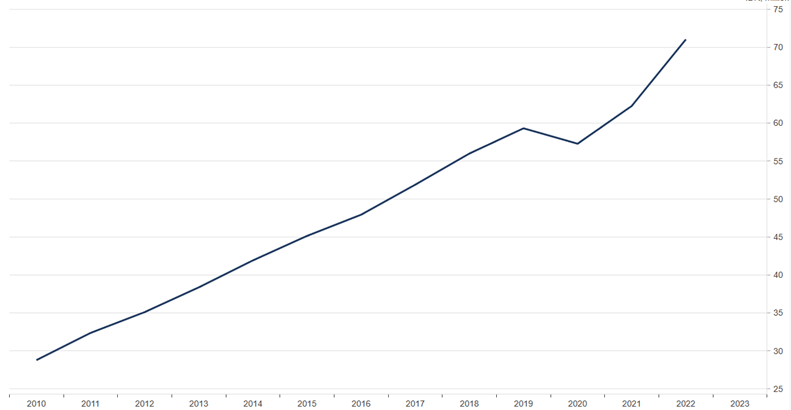

This is for good reason. The country has made remarkable economic and development progress since Jokowi, as he is widely known, came to power in 2014; GDP per capita has almost doubled over the last decade (see chart below) despite several years of Covid disruption.

Indonesia’s GDP per capita, millions of Indonesian rupiah (IDR)

Source: Macrobond, January 2023

The country’s infrastructure development has arguably been world-leading, and includes 16 new airports, 18 new ports, 2,000km of toll roads and the first high-speed rail in the ASEAN (Association of Southeast Asian Nations) region, connecting the cities of Jakarta and Bandung, and reducing journey time from over five hours to less than one.

Supporting the regions

It is not just physical infrastructure that Jokowi will be remembered for, however. In terms of social development, the country’s universal health-care system was implemented during his presidency, improving the nation’s health outcomes. Jokowi has also been a large supporter of the regions, helping to level up opportunities across the vast archipelago of 17,000 islands (around 6,000 of which are inhabited) and help other regions close the gap with Java, Indonesia’s economic epicentre.

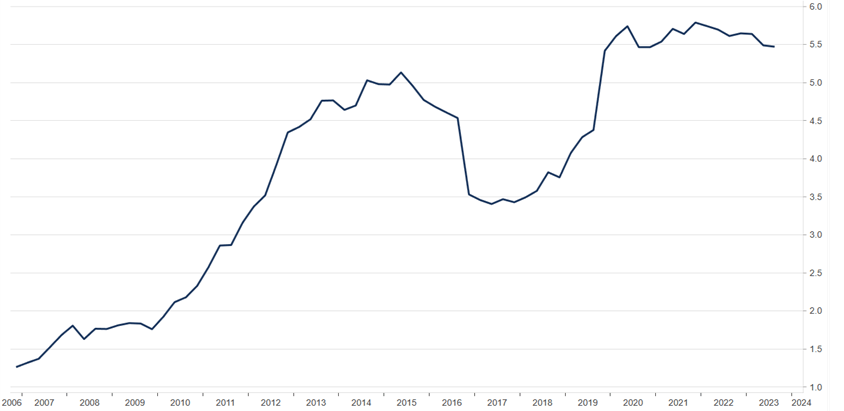

The other hallmark of Jokowi macro policy has been so-called ‘down-streaming’, under which the export of raw minerals was curbed to make way for increased domestic processing. This has been extended most recently in the sphere of electric-vehicle batteries and has already seen large foreign direct investment (FDI) commitment from a number of multinational companies – both Western and Asian. Under Jokowi’s leadership, quarterly inward FDI increased from a run rate of $2-3bn to around $5-6bn (see chart below).

Indonesian FDI (billions of US dollars)

Source: Macrobond, January 2023

Controversial policies

Naturally, in a country of Indonesia’s scale, complexity and level of development, not every aspect of Jokowi’s tenure has been free from controversy. Regional corruption and weak implementation of regulation, environmental degradation of virgin rainforest, and what could become a Jokowi vanity project – the new Indonesian capital of Nusantara in eastern Kalimantan – are some of the main issues that detractors could point to.

Furthermore, Jokowi’s involvement to install his son, Gibran Rakabuming Raka, on former rival Prabowo’s election ticket as potential vice president, even though this required a constitutional amendment owing to Gibran’s young age, has raised eyebrows. However, the fact that Jokowi continues to enjoy an approval rating of close to 80% at the end of his two terms, along with the economic development that Indonesia has enjoyed over the last decade, reflects a strong endorsement of his time in office.

Election and political dynamics

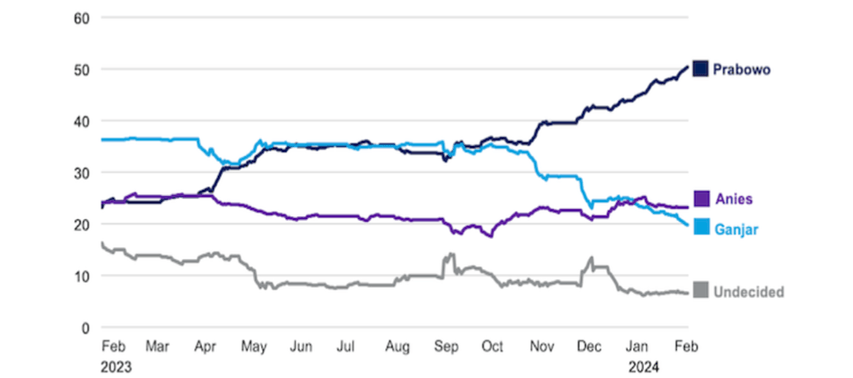

Although Prabowo has been polling extremely well, especially since Jokowi provided his endorsement by placing his son on Prabowo’s ticket in October 2023, the election may still go to a second-round run-off in late June. The new president-elect would then take office in October 2024.

Indonesia’s youthful demographics mean that the majority of voters will be aged 40 or younger, which has significant implications for voting behaviour. As a generalisation, social media is a much more important communication platform for younger voters. The identities of the candidates matter, as much as, if not more so, than their stated policies. This explains the boost in support that Prabowo has received since inviting Jokowi’s son, Gibran, onto his ticket (see chart below). If the election goes to a second-round run-off, voters are likely to pay more attention to the relative policy stance of candidates.

Presidential election voting intention: nine most reputable firms (seven-day moving average)

Source: Eurasia Group, February 2024.

Note: Surveys from 26 October take into account vice-presidential candidates.

Hardline policies

In broad terms, Prabowo Subianto, the current minister of defence, is regarded as a more populist, nationalistic and conservative candidate than his two rivals. As a former army lieutenant general and strongman, he could lean more towards hardline decision making, rather than deploying full consultation with his cabinet and advisers as would be more likely in the cases of Ganjar and Anies.

For investors, therefore, a Prabowo presidency could represent the strongest possible growth outlook for Indonesia, but this could come with higher ESG (environmental, social and governance) and/or foreign policy risks. Despite a somewhat higher level of governance uncertainty with Prabowo, including some risk of fiscal populism, we do not believe that he will push to remove the country’s 3% budget deficit to GDP limit, which is seen as an anchor of fiscal confidence for markets, and has contributed to the country’s financial strengthening under Jokowi.

Investment outlook and implications

As set out at the beginning of this article, all three presidential candidates will offer a version of continuity of Jokowi’s successful economic policies. In the short term, there may be some noise and volatility around the elections, particularly as markets seek more clarity on who will be selected to head key ministries such as the ministry of finance.

Beyond the next 10 months of political transition, we remain very constructive on the macroeconomic outlook for Indonesia and believe that emerging-market investors should consider being overweight the country owing to its superior economic growth potential and convergence with upper-middle income economies. We believe that Indonesia’s resource endowment and down-streaming policies mean that the country is extremely well placed to take advantage of the next generation of industrial development in electric vehicles and new energies.

‘China +1’ strategy boosts Indonesia

As global capital investment broadens out under the ‘China+1’ business strategy of avoiding investing solely in China and to include other growing emerging economies, we see Indonesia as one of the top five global beneficiaries. Indonesia’s independent central bank has done an excellent job of taming inflation in recent years and real interest rates remain among the most attractive globally, leaving the central bank with the space to begin its rate-cutting cycle imminently.

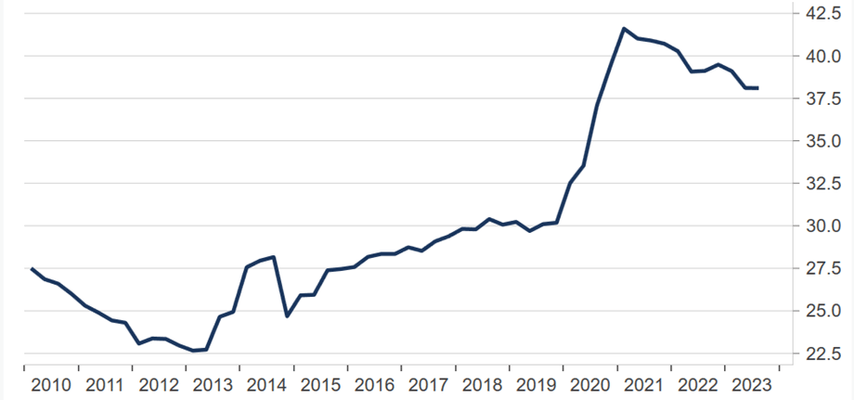

Last but not least, the fiscal discipline imposed by Indonesia’s finance ministry has succeeded in keeping national debt to GDP very subdued at below 40%, which has helped to create significant resiliency headroom to meet any future exogenous shocks (see chart below).

Indonesia’s government debt to GDP at current price (%)

Source: Macrobond, February 2024

This is a financial promotion. These opinions should not be construed as investment or other advice and are subject to change. This material is for information purposes only. This material is for professional investors only. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell investments in those securities, countries or sectors. Please note that holdings and positioning are subject to change without notice. Compared to more established economies, the value of investments in emerging markets may be subject to greater volatility due to differences in generally accepted accounting principles or from economic, political instability or less developed market practices.

Important information

This material is for Australian wholesale clients only and is not intended for distribution to, nor should it be relied upon by, retail clients. This information has not been prepared to take into account the investment objectives, financial objectives or particular needs of any particular person. Before making an investment decision you should carefully consider, with or without the assistance of a financial adviser, whether such an investment strategy is appropriate in light of your particular investment needs, objectives and financial circumstances.

Newton Investment Management Limited is exempt from the requirement to hold an Australian financial services licence in respect of the financial services it provides to wholesale clients in Australia and is authorised and regulated by the Financial Conduct Authority of the UK under UK laws, which differ from Australian laws.

Newton Investment Management Limited (Newton) is authorised and regulated in the UK by the Financial Conduct Authority (FCA), 12 Endeavour Square, London, E20 1JN. Newton is providing financial services to wholesale clients in Australia in reliance on ASIC Corporations (Repeal and Transitional) Instrument 2016/396, a copy of which is on the website of the Australian Securities and Investments Commission, www.asic.gov.au. The instrument exempts entities that are authorised and regulated in the UK by the FCA, such as Newton, from the need to hold an Australian financial services license under the Corporations Act 2001 for certain financial services provided to Australian wholesale clients on certain conditions. Financial services provided by Newton are regulated by the FCA under the laws and regulatory requirements of the United Kingdom, which are different to the laws applying in Australia.

Comments