Key Points

- With Russia on the backfoot as Ukraine steps up its counter-offensive, Ukraine’s President Zelensky is incentivized to push to regain as much territory as possible over the coming weeks.

- However, with US elections in 2024 and US military aid to Ukraine already costing $60bn, President Biden will be keen to show his electorate some progress and avoid another American ‘forever war’.

- Although there may well be more bloodshed in the weeks and months ahead, we anticipate that peace negotiations may commence in the coming months.

- We believe it is likely that the European Union will need to fund the lion’s share of Ukraine’s reconstruction – perhaps as much as 70% or €700bn.

- Equity sectors we believe could present opportunities include the obvious beneficiaries of physical reconstruction: construction, building materials, industrials and utilities.

In this blog, we explain why we believe the Wagner Group’s mutiny and early-stage coup on June 23-24 could be a potential gamechanger for the war in Ukraine. Although Wagner stepped down just 200km from Moscow in a deal brokered by Belarus’s President Lukashenko, Russian President Vladimir Putin’s leadership and scope for strategic flexibility appear to have been compromised.

The mercenary group’s leader, Yevgeny Prigozhin, laid bare the enormous folly, false pretenses and human cost of the war in Ukraine, while leaders from Russia’s military stood aside as his group occupied the city of Rostov-on-Don in southern Russia.

With most of the Wagner paramilitary group disbanded or in Belarus, the Russian war effort has lost its most potent and effective fighting force. It is likely that Putin must now be hyper-sensitive to the risk of sending additional resources (men) to perish in Ukraine as it heightens the risk of social instability at home and the prospect of further plots against his regime. To us, it seems that maintaining Russia’s chances of winning (not losing) the war in Ukraine will come at the cost of domestic stability: battlefield success and Russian domestic stability could be mutually exclusive outcomes.

Earlier Timeline for a Peace Deal

With Russia’s existing occupation of most of Donetsk and Luhansk creating a land bridge to Crimea, and facing the strategic risks highlighted above, we believe that Putin’s best move now would be to sue for peace. As such, we would expect back-channel peace negotiations sponsored by major actors including China and Turkey to step up over the coming weeks.

With Russia on the backfoot as Ukraine steps up its counter-offensive, Ukraine’s President Zelensky is incentivized to push to regain as much territory as possible over the coming weeks, and thus we believe it extremely unlikely that Ukraine will accept a peace offer in the first instance. The US and its NATO allies will also want to push for Ukraine’s maximum territorial reclaim and possibly test the stability of Putin’s regime.

Avoiding a ‘Forever War’

However, with US elections in 2024 and US military aid to Ukraine already costing $60bn, President Biden will be keen to show his electorate some progress and avoid another American ‘forever war’. In short, we anticipate that peace negotiations are likely to commence in the coming months, with a 60% chance of a ceasefire or peace deal by year end.

Sadly, this does not preclude the prospect of extremely violent and bloody warfare in the next few months as Ukraine and NATO push for maximum advantage. What the Wagner insurrection has done is to shift the Russian calculus in favor of an early peace deal in order to minimize domestic damage. This appears likely to mark a significant strategic shift from the prior focus on playing the long-game war of attrition.

Rebuilding Ukraine

Any peace negotiations will be centered on three key issues: defense guarantees for Ukraine, the territorial limits of either side (including demilitarized zone), and how the reconstruction of Ukraine will be financed. We examine these factors below:

- The reconstruction of Ukraine including its physical and social infrastructure is likely to cost up to €1 trillion[1] (for context, eurozone GDP is c. €15 trillion) over five to 10 years, or some US$100-200 billion per year.

- This could prove a conservative estimate; the reunification of Germany cost an estimated €2 trillion over 20 years, but East Germany was not a war zone with 8 million+ people displaced.

- The total population of East Germany in 1990 was 16.1 million, just over a third of Ukraine’s population today. Furthermore, the €2 trillion reunification cost was nominal. At inflated 2023 prices, this cost would be much higher.

- There has been recent debate in European Union (EU) circles as to whether Russia’s seized international reserves could be used to help fund the reconstruction. The latest sentiment by EU leaders appears skewed against doing this on legal grounds, and because of potential international repercussions for the euro if foreign-exchange reserve holders begin to de-risk euro exposure as a consequence.

- Despite these reservations, our view is that any peace deal with Russia will still be likely to feature a role for its confiscated international reserves. A reasonable assumption would be that 50% or c.US$150 billion could be requisitioned to help finance the reconstruction of Ukraine.

- Europe, the US and other wealthy international powers (including China) will need to fund the remainder. As the immediate neighbor and proximate beneficiary (and with Ukraine seeking to become an EU member in due course following a peace deal), it is likely that the EU will need to fund the lion’s share of Ukraine’s reconstruction – perhaps as much as 70% or €700 billion.

European Inflation and Bond Markets

Like other developed economies, Europe is currently in the middle of an inflation shock caused by previous rounds of Covid stimulus and a tight labor market, and this has been exacerbated by the Ukraine war. The latest core inflation print for the eurozone remains elevated at5.5% year on year as of the end of June.

While the European Central Bank’s (ECB)’s restrictive monetary policy (+400 basis points of hikes in under 12 months) is likely to grind inflation back towards the 2% target over the coming 12-18 months, this might barely have been achieved just as the eurozone faces its next great inflation shock: the enormous cost of taking on the bulk of Ukraine’s reconstruction cost.

Assuming €100bn in annual reconstruction costs for Europe, with half funded by the private sector and half by Brussels, the €50bn increase in annual cost would equate to a c.30% increase in EU budget spending – a sizeable fiscal expansion.

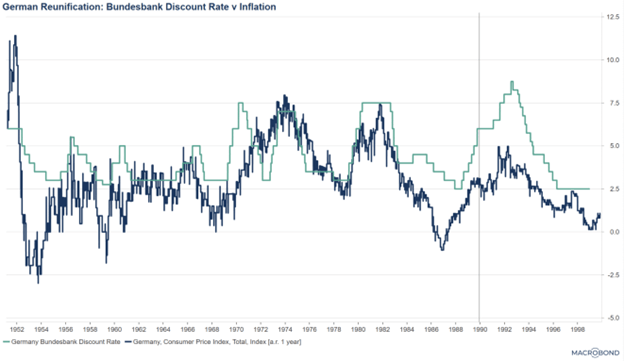

Germany’s reunification highlights how German inflation in the late 1980s and early 1990s rose from close to 0% to +5% with interest rates remaining elevated into the middle of the decade. Furthermore, the Bundesbank tightened monetary conditions very sharply, achieving positive real rates of +2-3% (in contrast to where real rates are in the eurozone today).

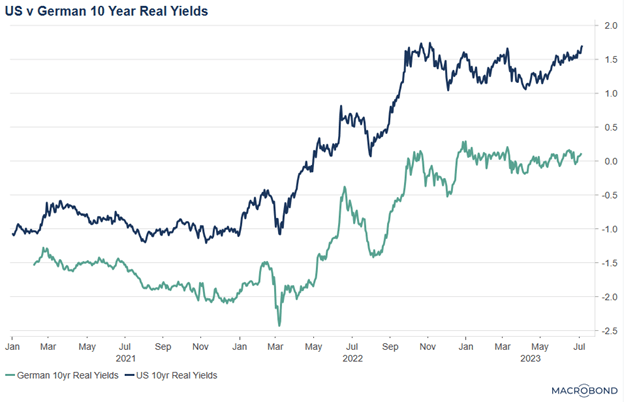

With the need to fund Ukraine’s reconstruction, the eurozone could emerge as an inflationary outlier compared with other parts of the developed world over the course of the remainder of this decade. This view, however, is not priced in by bond markets, with eurozone yield curves remaining among the lowest in the developed world. As the prospects of a peace deal, Ukrainian reconstruction, European majority funding and persistently elevated eurozone inflation become clearer over the coming quarters, European bond markets could gradually begin to reprice the risk of higher persistent inflation for the remainder of this decade.

Investment Opportunities

With higher inflation risks in Europe, we believe the ECB will need to remain hawkish and long-term real interest rates will need to move into positive territory as they have in the US. We believe there is merit in being short many of the eurozone sovereign curves, particularly at the front end where yields remain deeply negative in real terms.

If our outlook scenario for higher long-term eurozone inflation plays out owing to high fiscal spend on reconstruction (significant resources mobilized from western to eastern Europe/Ukraine), ECB policy will need to remain restrictive and rate differentials would favor the euro versus other major G10 currencies as other developed economies restore inflation and policy rates towards more neutral levels.

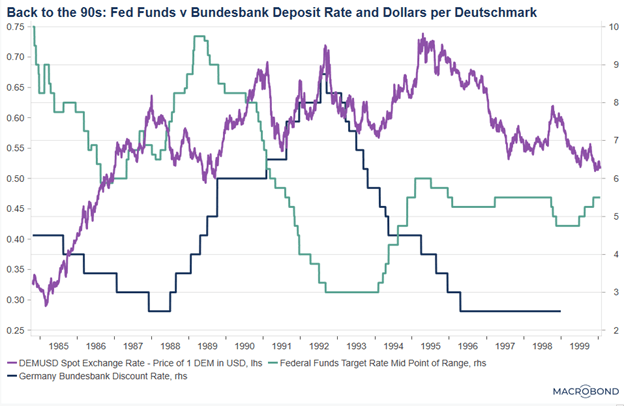

In the early 1990s German reunification precedent, the Deutschmark appreciated +40% versus the US dollar as the Bundesbank was in tightening mode while the Federal Reserve was cutting.

Equity sectors where we would be inclined to hunt for opportunities include the obvious beneficiaries of physical reconstruction: construction, building materials, industrials and utilities.

Source: Macrobond, 6 July, 2023

Source: Macrobond, 6 July, 2023

Source: Macrobond, 6 July, 2023

[1] Source: World Bank/European Commission/ UN estimate as of February 24, 2023 is US$411bn (€383bn) https://www.worldbank.org/en/news/press-release/2023/03/23/updated-ukraine-recovery-and-reconstruction-needs-assessment

Ukraine’s government estimate is higher: estimated $750bn even before the end of 2022

https://www.dw.com/en/how-much-could-it-cost-to-rebuild-ukraine/a-63533638

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice. For additional Important Information, click on the link below. Important Information For Institutional Clients Only. Issued by Newton Investment Management North America LLC (“NIMNA” or the “Firm”). NIMNA is a registered investment adviser with the US Securities and Exchange Commission (“SEC”) and subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”). The Firm was established in 2021, comprised of equity and multi-asset teams from an affiliate, Mellon Investments Corporation. The Firm is part of the group of affiliated companies that individually or collectively provide investment advisory services under the brand “Newton” or “Newton Investment Management”. Newton currently includes NIMNA and Newton Investment Management Ltd (“NIM”) and Newton Investment Management Japan Limited (“NIMJ”). Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. Statements are current as of the date of the material only. Any forward-looking statements speak only as of the date they are made, and are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking statements. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment and past performance is no indication of future performance. Information about the indices shown here is provided to allow for comparison of the performance of the strategy to that of certain well-known and widely recognized indices. There is no representation that such index is an appropriate benchmark for such comparison. This material (or any portion thereof) may not be copied or distributed without Newton’s prior written approval. In Canada, NIMNA is availing itself of the International Adviser Exemption (IAE) in the following Provinces: Alberta, British Columbia, Manitoba and Ontario and the foreign commodity trading advisor exemption in Ontario. The IAE is in compliance with National Instrument 31-103, Registration Requirements, Exemptions and Ongoing Registrant Obligations.

Important information

For Institutional Clients Only. Issued by Newton Investment Management North America LLC ("NIMNA" or the "Firm"). NIMNA is a registered investment adviser with the US Securities and Exchange Commission ("SEC") and subsidiary of The Bank of New York Mellon Corporation ("BNY Mellon"). The Firm was established in 2021, comprised of equity and multi-asset teams from an affiliate, Mellon Investments Corporation. The Firm is part of the group of affiliated companies that individually or collectively provide investment advisory services under the brand "Newton" or "Newton Investment Management". Newton currently includes NIMNA and Newton Investment Management Ltd ("NIM") and Newton Investment Management Japan Limited ("NIMJ").

Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed.

Statements are current as of the date of the material only. Any forward-looking statements speak only as of the date they are made, and are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking statements. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment and past performance is no indication of future performance.

Information about the indices shown here is provided to allow for comparison of the performance of the strategy to that of certain well-known and widely recognized indices. There is no representation that such index is an appropriate benchmark for such comparison.

This material (or any portion thereof) may not be copied or distributed without Newton’s prior written approval.