One of the most distinct aspects of current consumer trends is the growing move by millennials to spend money on experiences, rather than things. This spending shift has a host of implications for companies and investors.

In the past, social status was driven far more by the ownership of impressive or expensive items. If you wanted to make your wealth known, you would buy a big house or a fancy new car, and wear expensive clothes and jewelry. However, the general social climate is changing for young people, with material possessions no longer conveying the social currency they once did. In addition, experiences can have somewhat of a levelling effect, as the quality of an experience is more subjective, whereas most people can see the allure of a luxury sports car over a family hatchback. Now, experiences are the focus of millennial spending, with the ability to share experiences on social media amplifying this trend.

This change in consumer preferences will affect a number of different industries, most notably travel, restaurants, entertainment and companies in the wellness and fitness space.

In the US, all industries within the travel sector have exhibited strong growth this cycle. The standout performer has been the hotel industry, which has grown at 6% annually, while the cruise, car rental and airline industries are not far behind. In terms of destinations, some countries, such as Vietnam, are seeing visitor numbers grow by up to 30% annually. As flights around the world become cheaper, more convenient and more accessible to many, the travel sector is likely to benefit from a greater emphasis on buying experiences rather than things.

The Eating-Out Experience

Of course, international travel is still out of reach for the majority of the world’s citizens, and even domestic travel remains too expensive for many people around the globe. However, there are plenty of cheaper experiences that people are also spending money on at home. In the UK, the restaurant industry is well served by these trends, with 18-24 year olds eating out an average of 28.3 times per month! The comparable figure for those over 50 is a mere nine times per month.

The BBC explored the rise of Instagram on food and eating, and reported one restaurant owner’s view that “For us, today’s dining experience is no longer just about having great food and drink…It’s all about creating unique experiences that our customers can document on Instagram and social media.”[1] While there remain serious financial challenges to young people saving for the long-term, it is clear that younger generations do place a much higher premium on the experience of eating out and spend their disposable income accordingly.

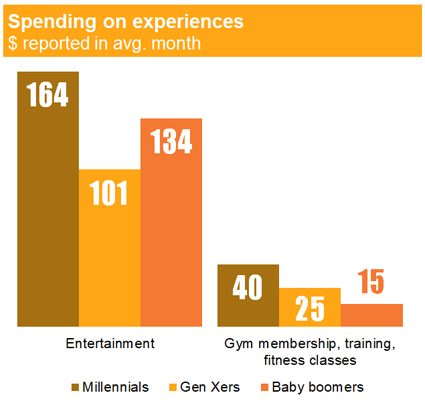

Another well-publicized new trend is that young people are more interested in fitness; millennial spending on health and appearance is particularly pronounced. In the UK, the value of the fitness market is up 6.3% year on year, considerably exceeding overall economic growth. At 15%, gym penetration is now at an all-time high. There are, of course, a host of other consumer sectors profiting alongside gyms and fitness equipment, with a renewed focus on health and wellness also driving sales of athletic wear, health-conscious foods and sports nutrition products. While these are clearly products rather than experiences, they are part of the overall experience of fitness and are a key spending area for younger generations.

Finally, entertainment is also benefiting from this consumer trend. Spending is rising across both the sports and audio-visual entertainment sectors, with the fastest growth rate of all being seen in eSports (competitions involving video games), which sit at the intersection of these two forms of entertainment. This market is predicted to grow at a 22% compound annual growth rate until 2022. Music is also positively affected by these tailwinds, with paid streaming services ushering in a new era for digital content. Some bricks-and-mortar stores are trying to incorporate experiential entertainment into the shopping experience, by offering nail bars, chill-out spaces or a bar or café for example to entice experience-driven shoppers.

Source: Cashing in on the US Experience Economy, McKinsey, Dec 2017

Keep It Social

With Facebook boasting 2.3 billion users and Instagram now having a billion active users every month, social media underpins the increased spending in all of these experience-related industries. In aggregate, Instagram users like 4.2 billion posts every day, with many of those posts sharing beautiful brunches, far-flung destinations, the latest workout or a weekend at a music festival. The social sharing of purchases makes even the act of buying a tangible item more of an experience, by arguably merging the material and experiential world.

Of course, it is always important to be mindful of the risks that accompany any economic trend. So far, many of these spending preferences appear to be concentrated with millennials, so there is no guarantee that the related trends will remain as powerful when millennials shift to spending more on housing and childcare, and as Gen Z (those born between the mid-1990s and mid-2000s) become the bulk of the younger demographic. While it is likely that Gen Z will also spend heavily on experiences, there is a chance that this is a trend unique to a single generation, whose relevance would thus moderate as demographics change. It is also possible that the shift from buying material things to preferring experiences is cyclical, and we may see a resurgence of spending on tangible items in the future.

While we always keep potential shifts in mind, for now it seems probable to us that greater spending on experiences is a trend that will continue to develop over the long term. We think this is likely to offer investment opportunities in the travel, fitness, entertainment and restaurants industries, and will be bolstered by increased usage of social media. Technology and millennials have united to drive a wallet share shift away from material possessions to experiences, and the consumer sectors – and investors – will, we believe, need to adjust accordingly

[1] https://www.bbc.co.uk/news/uk-england-london-42012732

Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice.

Important information

For Institutional Clients Only. Issued by Newton Investment Management North America LLC ("NIMNA" or the "Firm"). NIMNA is a registered investment adviser with the US Securities and Exchange Commission ("SEC") and subsidiary of The Bank of New York Mellon Corporation ("BNY Mellon"). The Firm was established in 2021, comprised of equity and multi-asset teams from an affiliate, Mellon Investments Corporation. The Firm is part of the group of affiliated companies that individually or collectively provide investment advisory services under the brand "Newton" or "Newton Investment Management". Newton currently includes NIMNA and Newton Investment Management Ltd ("NIM") and Newton Investment Management Japan Limited ("NIMJ").

Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed.

Statements are current as of the date of the material only. Any forward-looking statements speak only as of the date they are made, and are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking statements. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment and past performance is no indication of future performance.

Information about the indices shown here is provided to allow for comparison of the performance of the strategy to that of certain well-known and widely recognized indices. There is no representation that such index is an appropriate benchmark for such comparison.

This material (or any portion thereof) may not be copied or distributed without Newton’s prior written approval.