Key Points:

- Historically, publicly listed infrastructure investments have provided relatively stable absolute and risk-adjusted returns through market cycles.

- Listed-infrastructure securities are typically issued by companies with hard-asset-owning business models in heavily regulated industries, with contracts that allow them to pass inflationary pressures on to their end consumers.

- The stability of cash flows also provides downside support in difficult equity market environments.

Alternative investments are on the rise. These financial assets, which include hedge funds, private equity, real estate, infrastructure, commodities, private debt and liquid alternative mutual funds, accounted for 21% of global assets under management (AUM), or $20 trillion, in 2022. Currently, the growth trajectory for alternatives is second only to passively managed investments, with AUM expected to reach $29 trillion by 2027.1

For investors seeking to allocate to alternative investments, we believe listed infrastructure could be a compelling option. Infrastructure assets are expected to grow at a compound annual growth rate (CAGR) of 11% from 2022 to 2027, ultimately making up 7% of a $29 trillion global alternatives market.2 What are the key draws of listed infrastructure in the current environment? Listed infrastructure has historically delivered consistent mid-to-high single-digit total returns, above market yield. Furthermore, these assets may offer downside protection and a hedge against inflation, in addition to favorable long-term risk-adjusted returns relative to equities and other listed alternatives.

Current Market Environment

Inflation has begun to decelerate across developed economies, leading to a pivot in the expected path of interest rates. At the same time, governments are deploying trillions in global infrastructure funding to support energy-transition objectives and reshoring initiatives and to maintain aging infrastructure. Significant megaprojects, or large-scale projects that typically cost $1 billion or more, are expected to break ground in 2024 to reduce energy dependence and bring semiconductor supply chains closer to home.

Multiple infrastructure sectors, such as utilities and renewable energy, lagged in 2023 due to the rising interest-rate environment, as companies in these industries generally rely on debt markets to fund future growth. As the tide appears to be turning on the interest-rate front, sentiment for listed infrastructure is improving. Against this backdrop, our outlook for listed infrastructure is constructive, and we believe this alternative asset class could unlock opportunities for investors.

Stable Returns and Inflation Protection

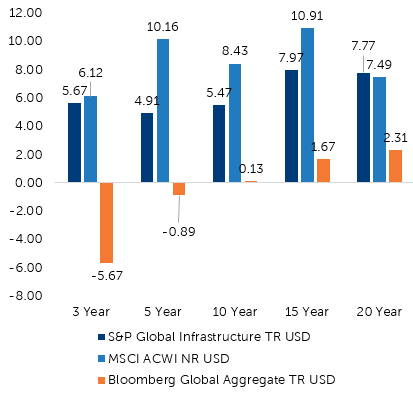

As shown below, listed infrastructure has delivered consistent mid-to-high single-digit total returns over the past 20 years, outperforming equities over that time period.3 The characteristics of listed infrastructure, which allow companies within the asset class to deliver income while also protecting against inflation, drive these steady return streams.

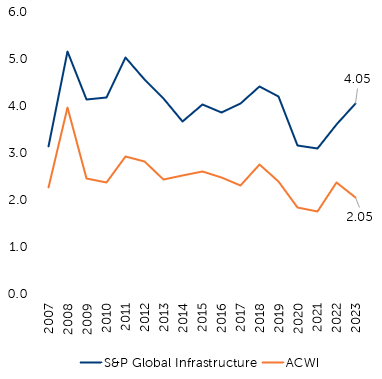

Income returns play a substantial role in the overall performance of listed infrastructure. Listed-infrastructure securities are typically issued by companies with hard-asset-owning business models in heavily regulated industries, with contracts that allow them to pass inflationary pressures on to their end consumers. These are typically dividend-paying equities, and as such can generate stable cash flows that similarly keep pace with inflation. Currently, infrastructure equities deliver a dividend yield twice that of global equities, as depicted below.4

The US inflation rate year over year has increased 3% or more during seven of the last 20 calendar years. During these seven years, listed-infrastructure equities have appreciated an average of 12.4%, versus global equities which have appreciated 7.5%.5 Likewise, infrastructure assets have been favorable investments historically when rates drop. US rates have fallen in 10 of the last 20 years, and in those 10 years, infrastructure has returned an average of 8.6%, while global equities have returned 7.7%.6

Downside Protection and Risk-Adjusted Returns:

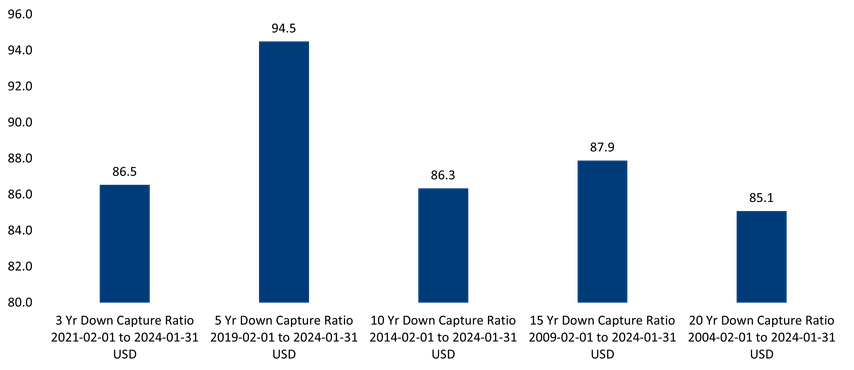

The stability of cash flows can also provide downside support in difficult equity market environments. Over the past 20 calendar years, the MSCI ACWI Index—which comprises large-cap and mid-cap equities across both developed and emerging markets—has dropped five times. In these down-market environments, listed infrastructure has fallen an average of 12.1%, as compared to global equities which have declined an average of 15.9%.7 This is evident in the downside capture ratio of the S&P Global Infrastructure Index versus the MSCI ACWI Index, which has generally been under 90% over the short and long term, indicating that infrastructure has declined only about 90% as much as the MSCI ACWI Index in the periods shown below.8

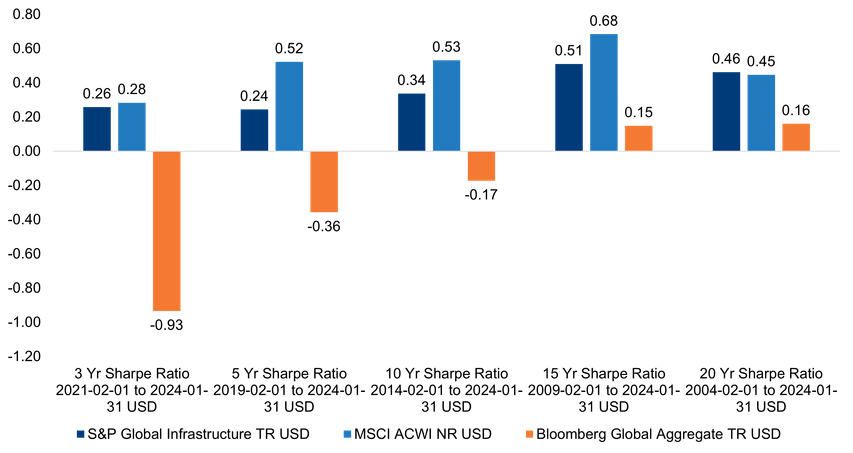

As illustrated in the chart below, infrastructure has delivered a higher Sharpe ratio (a measure of risk-adjusted return) versus equities over the past 20 years.9 The combination of relatively stable mid-single to high-single digit returns and downside protection, supported by the characteristics of listed infrastructure and stable cash flows, has resulted in positive risk-adjusted returns over the short, mid and long term.

Infrastructure Downside Capture Ratio

Sharpe Ratio

Multidimensional Research Support

Our approach to infrastructure investing is supported by our multidimensional research platform. Our research capabilities help us to more thoroughly evaluate investment opportunities and make better-informed decisions. Our specialists help us identify and investigate thematic tailwinds that could drive stock prices—such as decarbonization, deglobalization and aging populations. Our fixed-income analysts provide insights into the capital structure of our investments, while our investigative research team equips us with a better understanding of different regulatory environments and deeper research into our holdings and investable universe. Our specialist researchers speak with regulators, lobbyists, trade journalists, lawyers and market participants across the globe to explore the impacts of upcoming elections and evolving legislation, as well as potential risks and opportunities spanning telecommunication cables, wildfires, existing contracts, etc. Our multidimensional research team delivers an extra layer of insights, which we believe differentiates our approach to investing in publicly listed infrastructure.

Conclusion

Historically, publicly listed infrastructure investments have provided relatively stable absolute and risk-adjusted returns through market cycles. Infrastructure securities are issued by companies that provide services essential for societies and economies to function and thrive. These are generally companies that have hard-asset-owning business models in heavily regulated industries. Their revenues are often governed by long-standing contracts with built-in pricing increases linked to inflation, granting them the ability to pass inflationary pressures through to their clients. These mechanisms allow listed-infrastructure securities to deliver income while also protecting against inflation. In our view, there are considerable tailwinds supporting listed infrastructure securities and offering investors attractive opportunities in the space, especially those seeking yield and downside protection in turbulent markets.

[1] Boston Consulting Group. May 2023. https://web-assets.bcg.com/c8/97/bc0329a046f89c7faeef9ab6a877/bcg-global-asset-management-2023-may-2023.pdf

[2] Boston Consulting Group. May 2023. https://web-assets.bcg.com/c8/97/bc0329a046f89c7faeef9ab6a877/bcg-global-asset-management-2023-may-2023.pdf

[3] Morningstar as of January 31, 2024.

[4] Bloomberg as of December 31, 2023.

[5] Bloomberg and Morningstar. As of December 31, 2023.

[6] Bloomberg and Morningstar. As of December 31, 2023.

[7] Morningstar as of December 31, 2023.

[8] Morningstar as of January 31, 2024.

[9] Morningstar as of January 31, 2024.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice. MAR005950 Exp 03/29. For additional Important Information, click on the link below.

Important information

For Institutional Clients Only. Issued by Newton Investment Management North America LLC ("NIMNA" or the "Firm"). NIMNA is a registered investment adviser with the US Securities and Exchange Commission ("SEC") and subsidiary of The Bank of New York Mellon Corporation ("BNY Mellon"). The Firm was established in 2021, comprised of equity and multi-asset teams from an affiliate, Mellon Investments Corporation. The Firm is part of the group of affiliated companies that individually or collectively provide investment advisory services under the brand "Newton" or "Newton Investment Management". Newton currently includes NIMNA and Newton Investment Management Ltd ("NIM") and Newton Investment Management Japan Limited ("NIMJ").

Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed.

Statements are current as of the date of the material only. Any forward-looking statements speak only as of the date they are made, and are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking statements. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment and past performance is no indication of future performance.

Information about the indices shown here is provided to allow for comparison of the performance of the strategy to that of certain well-known and widely recognized indices. There is no representation that such index is an appropriate benchmark for such comparison.

This material (or any portion thereof) may not be copied or distributed without Newton’s prior written approval.

In Canada, NIMNA is availing itself of the International Adviser Exemption (IAE) in the following Provinces: Alberta, British Columbia, Manitoba and Ontario and the foreign commodity trading advisor exemption in Ontario. The IAE is in compliance with National Instrument 31-103, Registration Requirements, Exemptions and Ongoing Registrant Obligations.