We examine the long-term global structural impacts of the Ukraine war and Russia’s pariah status.

By Richard Bullock, CFA

Key Points

- Russia’s invasion of Ukraine marks the end of Europe’s 30-year post-Cold War peace dividend.

- We anticipate higher defense spending, particularly by European countries following on from Germany’s early lead. There is likely to be greater defense cooperation between allies which supports America’s leading defense industry.

- As Russia and China look more likely to form an ever-closer alliance distanced from the West, it may become challenging to coordinate global climate efforts with these two crucial countries.

- We believe the global middle-class consumer base is likely to grow at a much smaller rate from here, presenting a weaker growth backdrop for global consumer-facing multinationals.

- The Ukraine war and its fallout is likely to hasten the reconsideration of the role that the US dollar plays in international finance and trade settlement.

- Our base-case assumption is that Russia’s economy will face a significant decline in 2022, followed by slow-grind stagnation in the years to come, rather than an existential crisis and ultimate collapse.

Russia’s invasion of Ukraine and the resulting Western sanctions have definitively ended Europe’s 30-year post-Cold War peace dividend. The event came as a shock to financial markets as the largest invasion of a European sovereign nation since 1945, but we view it as merely the most recent (albeit profound) event on the unfolding global geopolitical tapestry that began shortly after the global financial crisis in 2010. In this blog we discuss some of the long-term structural impacts that markets can expect as a result of the Ukraine war and Russia’s exclusion from the Western economic order.

1: Evolving Geopolitical World Order

Russia’s invasion of Ukraine will reshape the geopolitical landscape and world order for the next decade and beyond, regardless of whether Ukraine ultimately falls to Russian forces. By necessity, the US’s 2012 ‘Pivot to East Asia’ strategy under President Obama has been superseded in the medium term by a ‘Pivot back to Europe’ strategy. We believe the US and its allies will maintain a strong presence in the Indo-Pacific, but the near-term security focus will shift to the actual theatre of conflict, which for now is eastern Europe. This could embolden China incrementally and make East Asian allies more nervous. Furthermore, the heavy sanctions placed on Russia by the US and Europe is likely to strengthen the Sino-Russian relationship to an even greater degree as Moscow increases its trade and financial dependency on Beijing. The US’s use of the dollar financial system to sanction Russia (and threat of doing so to China) will probably encourage China, Russia and other authoritarian states to consider alternative international payment systems for cross-border trade.

It is likely that the US and its allies will seek rapprochement with certain existing adversaries as necessity dictates. There is now a high probability of the Iran Joint Comprehensive Plan of Action (JCPOA) nuclear deal being restored. The US has even been in discussions with the heavily sanctioned Venezuelan regime regarding additional oil supplies. This reshuffling of global adversaries may limit near-term economic pain but could create other geopolitical distortions in the medium term. For example, providing Iran with billions of dollars of fresh revenues and removing certain sanctions could pave the way for future proxy wars and violence across the Middle East as Iran expands its sphere of influence. Saudi Arabia has already taken exception to this prospect and threatened to price a portion of its oil exports in Chinese yuan – a move that could begin to challenge the absolute hegemony of the US dollar. In short, the long-term geopolitical implications of Russia’s invasion of Ukraine and resulting international power dynamics are still taking shape but will have far-reaching impacts for financial markets.

New Iron Curtain

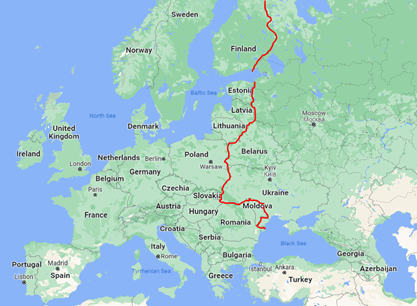

It is too early to know what the fate of Ukraine holds, but while Russian forces occupy the country’s territory, the iron curtain has been drawn across Europe once again in a line that conforms to the western borders of Belarus and Ukraine and the eastern borders of the Baltic states, Poland, Slovakia, Hungary and Romania. These latter countries will be likely to receive heightened levels of spending and support from NATO but their direct frontage onto the new iron curtain, risk of potential friction with a hostile Russia and destabilizing migration flows could also raise their sovereign cost of capital in the medium term. Furthermore, the opportunities for trade that these countries had with Ukraine, Belarus and Russia could also disappear, removing an avenue of economic growth.

The New Potential ‘Iron Curtain’?

Source: Google Maps, Newton, 2022

2: National Security Reprised

For the last three decades since the end of the Cold War, the West has existed according to Francis Fukuyama’s ‘end of history’ paradigm, a naïve assumption that the peace dividend would persistently endure. There was 9/11, the wars in Afghanistan and Iraq along with other regional conflicts, but the notion that great power confrontation had ended was the consensus. This allowed for commerce, free trade and globalization to prevail and for living standards to generally improve.

Russia’s invasion of Ukraine is now forcing a clear-eyed reassessment in the Western world, particularly in Europe, but to a lesser degree in the US too, of national security prioritization. The West now finds itself in the situation where national security concerns will usurp the enhancement of prosperity and living standards for a period of time. How long this period endures is unknown and will depend on the ability to substitute supply chains and on the level of hostility shown by Russia and its security partners. However, we are already seeing clear evidence of the domestic pendulum swinging towards national security over living standards, for example with Germany’s cancellation of the Nord Stream 2 gas pipeline, US and UK sanctions on Russian oil purchases despite crude prices at US$120 a barrel, and Germany’s pledge to increase defense spending by around 50%.

Potential Investment Implications: expect higher defense spending, particularly by European countries following on from Germany’s early lead. There is likely to be greater defense cooperation between allies which supports America’s leading defense industry. Militaries will also need to be modernized with the latest equipment, which supports technology players in the industry. The private (and government) sector will also need to step up its spending on cybersecurity as Russian ‘gray zone’ activity could remain a constant.

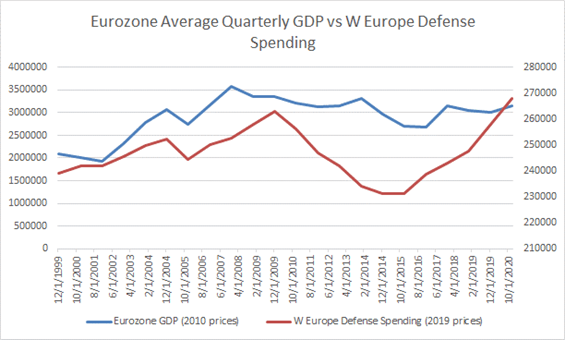

End of the European Peace Dividend

Source: Bloomberg, SIPRI, Newton, 2020

3: Climate Change Reimagined

Glasgow’s COP26 summit last year is very likely to symbolize the high-water mark for global coordinated climate efforts over the medium term. As confrontation with Russia has literally become a matter of keeping the lights turned on and European industrial plants running, the scramble for any source of energy, irrespective of carbon content, is currently underway. Thermal coal prices have more than doubled so far this year and European natural gas prices remain at multi-year highs. The challenge of abating climate change has not disappeared, but its prioritization has been relegated in the face of conflict with Russia. Furthermore, as Russia and China form an ever-closer alliance distanced from the West, it will become challenging to coordinate global climate efforts with these two crucial countries: China as the world’s largest CO2 emitter, and Russia as a vital supplier of many of the resources needed to attain the energy transition.

Yet climate optimists should not give up hope, nor should governments, businesses and communities give up their efforts. In the near term, perhaps on a one-to-two-year horizon, the world’s CO2 intensity of energy is likely to rise as emergency sources of fossil fuels including coal are burned to replace curtailed natural-gas supplies from Russia. Over the medium term, however, beyond this two-year horizon, countries could double down on their clean-energy efforts because this is now tied inextricably to a national security agenda and not solely to climate-change abatement.

The national security benefit of clean energies including wind, solar, hydrogen and nuclear is that the electrons are produced and consumed in the same country most of the time, without the need to traverse borders, and therefore removing some of the geopolitical risks and complexities associated with fossil fuels. What markets need now from governments is a new energy policy that combines both climate and national security considerations and moves away from former idealistic notions that economies can fully transition to wind, solar and hydrogen without the support of nuclear, and without a medium-term support role from fossil fuels.

Potential Investment Implications: the lifespan of fossil fuels may be extended. Some assets that were previously ‘stranded’ could become ‘unstranded’. A more holistic conception of energy transition should also include a greater role for nuclear energy. Clean energy could enjoy a dual tailwind of climate and national security, but the pace of adoption might be more pragmatic, given the failings of Europe’s existing energy policy.

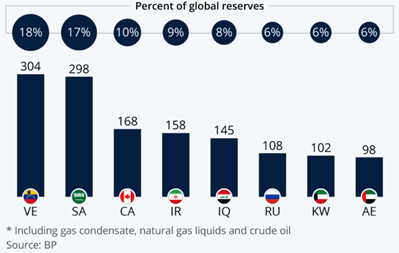

The chart below examines global oil reserves (in billion barrels), which represents, for some of these countries, a renewed medium-term relevance within the global energy complex:

Amounts and Percentage of Global Oil Reserves (Billion barrels)

Source: BP, Statista, February 2022

4: Deglobalization and Supply Chains

Historians in years to come may well look back on Russia’s February 24 invasion of Ukraine as the event that definitively ended the last 30-year process of international integration and globalization, rather as the assassination of Archduke Franz Ferdinand in Sarajevo in June 1914 brought a sudden halt to the 30 years of rapid globalization that preceded it.

To be clear, globalization, or the free flow of goods, capital, people and ideas, was already under heavy assault before Russia’s invasion of Ukraine, with global trade as a percentage of global GDP peaking around 2008. Russia’s 2014 annexation of Crimea and resulting sanctions, the Trump administration’s ‘America First’ doctrine on trade and China’s ‘dual circulation’ self-sufficiency policy have all been steps in the further fraying of globalization, but none has been so wrenching and sudden as the Western trade and financial sanctions that have cut Russia out of the global economy almost overnight following its invasion of Ukraine.

McDonald’s is often portrayed as one of the great symbols of free trade and globalization, with the golden arches opening its first outlet in Russia’s Pushkin Square in January 1990. In a sign of how much things have receded, McDonald’s announced the suspension of operations for all of its 867 restaurants in Russia last weekend. Russians with a taste for Western consumerism and a memory of the dull Soviet era were reportedly stockpiling Big Macs in their home freezers.

The story may seem fairly innocuous and, perhaps, even mildly entertaining, but the case of decoupling Russia’s 144 million consumers from the global economy could have broader significance. In the aftermath of World War I, the world did not return to a globalized trade order, anchored by the gold standard and the hegemony of the British Empire. The fragmentation of the inter-war years was followed by the horrors of World War II and then by the Cold War, effectively dividing world trade and commerce into two distinct camps and a small residual of ‘non-aligned’ countries.

It is difficult to predict at this juncture precisely how globalization will play out but the indications of recent years, now accelerated by Russia’s invasion of Ukraine, point towards two possible defining features. The first is a preference for more localized production and a near-shoring of supply chains for national security purposes. The second is a common values-based alliance between democracies that value freedom and human rights, and between autocratic countries that favor domestic order and stability. Between the Western alliance and the China-led alliance, there may be many small and mid-sized countries that opt for a non-aligned status.

Potential Investment Implications: one of the major possible implications of a deglobalized world in which fewer goods, capital and ideas traverse borders as a portion of GDP is a level of overall lower productivity growth and higher inflation. Domestic labor markets in developed economies are likely to remain tighter, while labor markets in certain developing economies could slacken. Inequality could decline within mature economies – reversing the last 30-year trend – but simultaneously rise between developed and developing economies. As the bargaining power of lower-income workers rises in developed countries, so too could their purchasing power, which should support domestic consumption. As domestic capital investment increases in order to shorten supply chains, we would expect industrial automation to be a significant beneficiary, particularly in light of tight domestic labor markets. Finally, the global middle- class consumer base, which has become such a defining feature of the last 30 years of globalization, is likely to grow at a much smaller rate from here, presenting a weaker growth backdrop for global consumer-facing multinationals.

5: Global Inflation and US Dollar Privilege

The structural macro factors discussed above – geopolitical realignment, higher security spending, a reappraisal of the energy complex and deglobalization of supply chains – tend to have an inflationary bias in our view, and even more so when taken in parallel. Barring a deep or prolonged global recession in which aggregate demand falls materially short of global output capacity, inflationary pressures will persist for longer. These pressures could be extended by the response of the world’s major central banks, which have a proven preference for patience, and have demonstrated caution around tightening monetary conditions too sharply, effectively accommodating inflationary conditions.

We see modern day parallels to the 1970s which witnessed a geopolitical event in the shape of the 1973 Yom Kippur war between Israel and several Arab states, followed by a commodity supply-chain shock (oil embargo) that led to a sharp spike in energy prices. Central banks were generally slow to tackle inflation during the period, with the US running expansionary fiscal spending to fund the war in Vietnam. It took a bold Federal Reserve (Fed) policy under the stewardship of Paul Volcker in the early 1980s to finally break the inflationary wage-price spirals and restore price stability, albeit at the cost of a sharp jolt to the economy. Despite Jay Powell’s increased hawkishness of late, it is unlikely the Fed chair is even remotely close to the point of administering the Volcker-style medicine required to bring inflation back to target. With global geopolitics expected to remain volatile for an extended period, and latent supply-chain disruptions still occurring from the Covid-19 pandemic (China locked down its Shenzhen technology hub of 18 million people on March 14), we believe that inflation is likely to remain both elevated and volatile for longer.

The fallout from the Ukraine war will also have implications for the US dollar and its long-term role both as the world’s hegemonic reserve currency and as the principal means of conducting international payments. Russia’s belligerence has been met with strong financial sanctions targeting a number of the country’s leading commercial banks but also, critically, its central bank. This effectively prevents the Central Bank of Russia from deploying its dollar (and euro) exchange reserves to meet its economic requirements.

The ‘dollar privilege’ has given the US the capability to use its currency and financial system to sanction adversaries, which they have been doing for some time in the cases of Iran and North Korea, for example. For revisionist powers such as Russia and China, the weaponized financial power of the US dollar has become an acute sensitivity – and Achilles heel – to their geopolitical ambitions. As a consequence, they have been taking steps to de-dollarize their economies and financial exposures.

Increasingly, middle powers are also showing increasing frustration at the US’s ability to stymie trade opportunities through the use of the dollar and are exploring alternative arrangements. For example, Saudi Arabia has announced that it is exploring the potential to price some oil exports in renminbi, while India is exploring a rupee-ruble bilateral-trade mechanism for trading with Russia.

The Ukraine war and its fallout could therefore hasten the reconsideration of the role that the US dollar plays in international finance and trade settlement. History shows that long-established international currency regimes do not change overnight, but once a number of large economies explore and trial alternatives, the longer-term process of de-dollarization could be set in motion. That would have far-reaching implications for the US cost of capital, the size of US deficits and the international role of the Treasury market.

Potential Investment Implications: we would advocate a real return and dynamic approach to investing in this environment. Owing to the volatility of both geopolitics and inflation, even traditional inflation hedging assets including gold, energy, industrial commodities and equities with pricing power are likely to experience volatility. Therefore, we believe a well-diversified portfolio in terms of assets and currencies, with inflation-hedging where possible, is key.

US 5-Year Inflation Break-evens Have Surged:

Source: Bloomberg, 18/3/22

The Outlook for Russia’s Economy

There is little doubt that the trade and financial sanctions imposed on Russia’s economy by the West will cause significant economic pain in the months and quarters ahead. Realistic estimates assume that Russia’s economy will decline in real terms by 15% in 2022[1]. The misery of Russian households will be compounded by the withdrawal of Western brands from the country and by high inflation as a consequence of supply-chain shortages and the 50% collapse in the value of the ruble. Sanctions on Russia’s central bank, its inability to use the SWIFT international payment system, and restrictions on its reserve holdings of euros and US dollars, also constrain the country’s ability to overcome the macro shock of sanctions. However, Russia does have several notable features that can help dull the economic pain. First, the Kremlin has been preparing its ‘fortress’ economy for siege-like conditions ever since the first significant sanctions were imposed on it following the 2014 Crimea annexation. Trade with the US was already at a low level and Moscow had been substituting many of the consumer-goods imports from European countries with its own home-grown goods. Second, strong relations with China are likely to provide the Russian economy with a lifeline. The two countries have grown bilateral trade to US$150bn per year, and recently pledged to grow this to US$250bn in the coming years, with the West’s withdrawal likely to hasten the attainment of this level[2].

China could serve as the marginal buyer of Russian energy and metals. It will be likely to put its military-industrial-technology sectors at the service of the Russians and could aim to fill part of the consumer goods void left by Western brands. Trade between Russia and China is likely to be financed in rubles or renminbi using China’s alternative international payment system (CIPS) and would be facilitated by Chinese policy banks that are immune from US commerce and sanctions. Our base-case assumption is therefore that Russia’s economy will face a significant decline in 2022 followed by slow-grind stagnation in the years to come, rather than an existential crisis and ultimate collapse, such as that faced by the Soviet Union between 1989 and 1991.

If President Putin can prevent a precipitous decline in real living standards, maintain employment at acceptable levels and contain battlefield casualties to a level that prevents collapse in national morale, his state media propaganda, now the monopoly on domestic news, should help avert social revolution. Of course, the Russian status quo looks a lot less certain than it did a month ago, and Russia has already experienced two revolutions over the course of the 20th century, but our base case in this instance is a muddling through with Chinese support, for it would not be in Beijing’s interest to see the fall of the Putin regime, or a Russian bear grizzly and incapacitated on its northern frontier.

[1] Reuters, March 10 2022 article. https://www.reuters.com/markets/rates-bonds/russias-gdp-fall-15-this-year-ukraine-linked-sanctions-iif-2022-03-10/

[2] Reuters, March 1 2022 article. https://www.reuters.com/markets/europe/china-russia-trade-has-surged-countries-grow-closer-2022-03-01/

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice. For additional Important Information, click on the link below.

Important information

For Institutional Clients Only. Issued by Newton Investment Management North America LLC ("NIMNA" or the "Firm"). NIMNA is a registered investment adviser with the US Securities and Exchange Commission ("SEC") and subsidiary of The Bank of New York Mellon Corporation ("BNY Mellon"). The Firm was established in 2021, comprised of equity and multi-asset teams from an affiliate, Mellon Investments Corporation. The Firm is part of the group of affiliated companies that individually or collectively provide investment advisory services under the brand "Newton" or "Newton Investment Management". Newton currently includes NIMNA and Newton Investment Management Ltd ("NIM") and Newton Investment Management Japan Limited ("NIMJ").

Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed.

Statements are current as of the date of the material only. Any forward-looking statements speak only as of the date they are made, and are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking statements. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment and past performance is no indication of future performance.

Information about the indices shown here is provided to allow for comparison of the performance of the strategy to that of certain well-known and widely recognized indices. There is no representation that such index is an appropriate benchmark for such comparison.

This material (or any portion thereof) may not be copied or distributed without Newton’s prior written approval.

In Canada, NIMNA is availing itself of the International Adviser Exemption (IAE) in the following Provinces: Alberta, British Columbia, Manitoba and Ontario and the foreign commodity trading advisor exemption in Ontario. The IAE is in compliance with National Instrument 31-103, Registration Requirements, Exemptions and Ongoing Registrant Obligations.