Economic and market background

Table Mountain, which overlooks the city of Cape Town in South Africa, is a popular tourist attraction and one of the world’s most identifiable landmarks owing to its distinctive flat top – a two-mile level plateau – which resembles a table. In August, the mountain became an analogy for the likely path of interest rates, with Bank of England Chief Economist Huw Pill telling a conference hosted by the South African central bank that the trajectory of UK interest rates was more likely to resemble Table Mountain, with a high flat top, than Switzerland’s Matterhorn, which has a much higher peak but then descends rapidly.

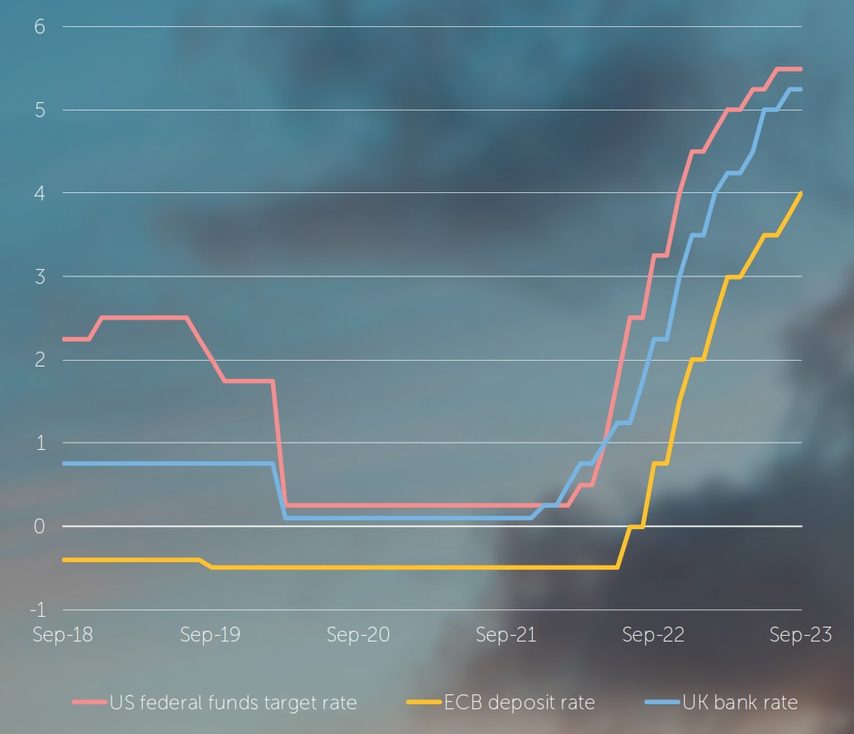

The UK has not been alone in promoting a ‘higher-for-longer’ mantra. In a speech at the Jackson Hole annual economic symposium in late August, US Federal Reserve (Fed) Chair Jay Powell warned that inflation remained “too high” and that the Fed intended to “hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective”.1 Although the Federal Open Market Committee (FOMC) decided to keep interest rates on hold at the Fed’s September meeting, the FOMC’s ‘dot plot’ projections signalled support for a further rate rise this year, and showed median expectations for only 0.50% of rate cuts in 2024.2 Meanwhile, the European Central Bank (ECB) raised its deposit rate to an all-time high of 4% in September, exceeding its previous 2001 record. While the ECB hinted that borrowing costs may have peaked, President Christine Lagarde stated that rates “will be set at sufficiently restrictive levels for as long as necessary”.3

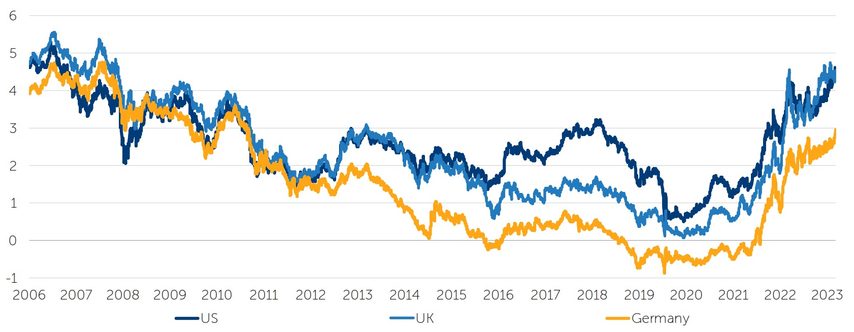

10-year government bond yields (%)

Source: FactSet, October 2023.

With governments playing a larger role in economies through increased spending, government bond supply has been rising, resulting in indigestion in bond markets and higher yields. The hawkish backdrop, with expectations of a plateau rather than a cut in interest rates, together with a rising oil price, served to reinforce the inflationary narrative for bond investors during the quarter. The yield (which moves inversely to price) on the benchmark US 10-year US Treasury bond rose by almost 0.8% during the quarter, touching its highest level since 2007. German 10-year bund yields also reached their highest point in more than a decade at the end of the quarter, and the yield on UK 10-year gilts returned to levels seen last autumn when former Prime Minister Liz Truss’s short-lived administration caused panic in the market by announcing unfunded tax cuts.4

While stock markets remained buoyant in July, the growing realisation that higher interest rates are likely to be around for the long haul was a key factor in causing the rally to stumble in August. The sell-off in US equities gathered pace in September, and the S&P 500 registered its first down quarter of the year. Most other equity markets were also in negative territory by quarter end, although the UK and Japan were exceptions to this trend.

The state of the Chinese economy added to investors’ concerns. Although a constructive tone for policy support from China’s government boosted emerging-market equities early in the period, a series of negative headlines, including weak manufacturing data and fragile consumer confidence, led sentiment to weaken as the quarter progressed. Structural pressures facing the country’s property sector also continued to attract investors’ attention. Figures from China’s National Bureau of Statistics indicated that the country’s post-Covid rebound had lost momentum in the second quarter, with the economy growing only 0.8% versus the previous three months and putting in doubt its ability to act as an important engine of global growth once again.

In fixed-income markets, gilts, as represented by the FTSE Actuaries UK Conventional Gilts All Stocks Index, returned -0.6% over the quarter (-4.1% over the nine months to 30 September), while overseas government bonds, as measured by the JP Morgan Global Government Bond Index (excluding the UK), produced a return of -0.3% in sterling terms (-4.9% over nine months). Corporate bonds, as represented by the ICE BofA Sterling Non-Gilt Index, returned +2.2% over the quarter (+1.2% over the year to date).5

While many major equity markets made losses over the three-month period in local-currency terms, the weakness of the pound boosted returns for UK-based investors. Japanese equities were the top performer in sterling terms, returning +3.1% over the quarter (+9.6% over nine months), while emerging-market equities returned +2.6% (+0.8% over the year to date). Meanwhile, UK stocks delivered a return of +1.9% (+4.5% over nine months) and North American equities rose by +1.0% (+11.5%) in sterling terms. Elsewhere, Asia Pacific ex Japan equities fell by -1.1% over the quarter (-0.1% over nine months) and Europe ex UK stocks returned -1.6% (+7.5% over the year to date) to UK-based investors.6

Gold delivered a negative return of -3.7% in US-dollar terms over the quarter (+1.3% over the year to date), while in sterling terms the precious metal produced a negative return of -0.2% (+0.5%).7

Regional overview

Citing a worsening fiscal situation, an increasing government debt burden and decreasing governance standards, ratings agency Fitch downgraded the credit rating of the US from AAA to AA+ at the start of August. Given there is no realistic equivalent to US Treasuries as a safe-haven asset, the downgrade is unlikely to have significant market implications, but it does put a spotlight on the continuing dysfunction in Washington and the challenging backdrop that the US and other developed economies face, with higher debt levels following the post-pandemic policy response and rising debt-servicing costs after a rapid increase in interest rates.

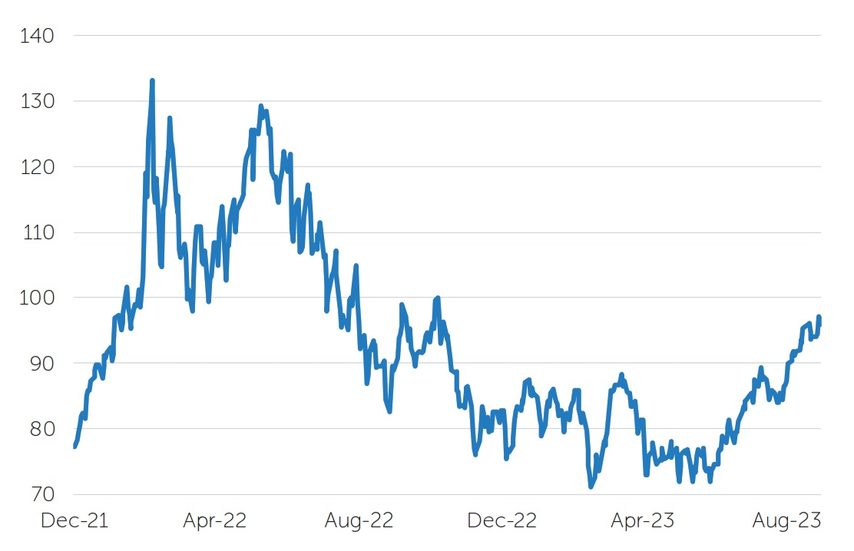

Investors were briefly buoyed at the start of September when it was revealed that the US labour market had cooled in August, with unemployment rising to 3.8% from 3.5% in July and wage growth slowing,8 fuelling hopes of a ‘Goldilocks’ scenario in which the Fed manages to tame inflation without causing a recession. However, inflation figures released by the Bureau of Labor Statistics in mid-September showed that the consumer price index had risen by 3.7% year on year in August, with inflation on a monthly basis also slightly stronger than expected.9 A key driver of this was the rise in petrol prices, which increased by over 10% in August alone as the oil priced ticked up, potentially becoming a weight on consumers and a threat to the disinflationary narrative.

Oil price

Brent crude, US$/barrel

Source: FactSet, October 2023.

The UK economy was the subject of some rare good news at the end of the quarter when the Office for National Statistics issued revised figures which suggested that the economy recovered from the Covid-19 pandemic much faster than previously estimated, and is now larger than its pre-pandemic level – putting it ahead of Germany in its recovery. The data also revealed that UK household spending had grown by 0.5% and household disposable income had increased by 1.2% in the second quarter of 2023.10

While the UK’s inflation rate is still higher than that of many of its developed-market counterparts, the surprise fall in all key measures of annual inflation in August may have played a part in the Bank of England Monetary Policy Committee’s knife-edge decision to hold interest rates at 5.25% at its 21 September meeting.11 Nevertheless, concerns that inflation may become entrenched remain; over the three months to July, although the jobs market appeared to be cooling, wages increased by 7.8% on an annual basis, the highest rate since comparable records began, and ahead of the increase in consumer prices, which rose 6.8% in the year to July.12

Although the ECB raised interest rates to a new high of 4% on 14 September, easing European inflation – which fell to a two-year low of 4.3% in September – and signs of faltering growth have led many to predict that the central bank’s tightening cycle has reached its peak. The HCOB (Hamburg Commercial Bank) flash composite purchasing managers’ index, which measures activity at companies across the eurozone, reported the fourth successive monthly decrease in new orders. Manufacturing demand continued to fall, while the service sector suffered the biggest decline in new business since the Covid-19 pandemic.13

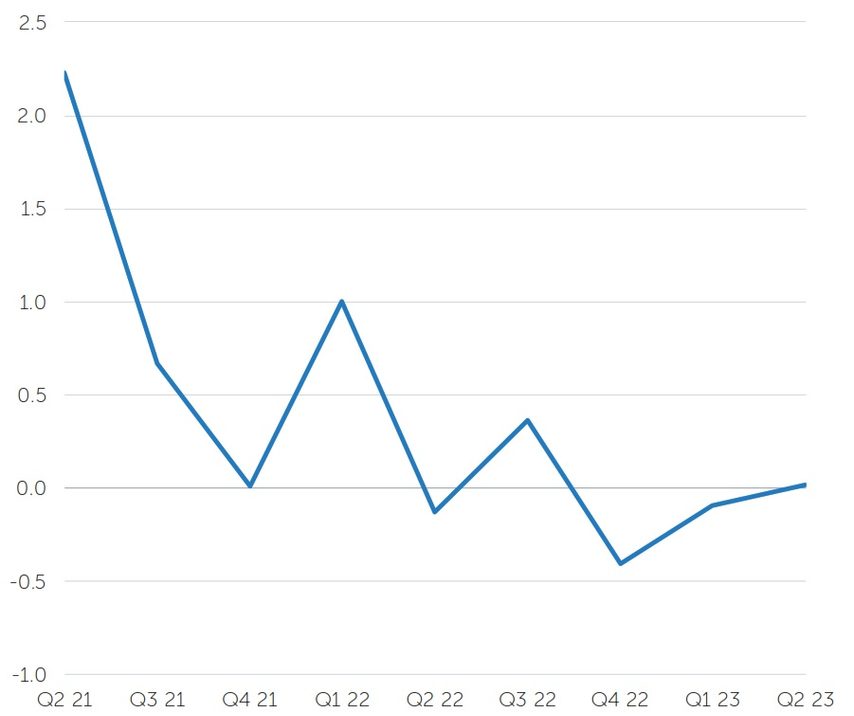

In particular, Germany, the eurozone’s largest economy, has suffered owing to its large manufacturing sector, which has been hit hard not only by a slowdown in trade with China, but also by the high energy costs triggered by Russia’s invasion of Ukraine. This has had a big impact on the country’s energy-intensive industrial sectors, including chemicals, glass and metals, which have seen a 17% fall in production since the start of 2022.14

Germany – real GDP growth

% change on previous quarter

Source: FactSet, October 2023.

In late July, the Bank of Japan (BoJ) ‘tweaked’ its yield-curve control policy (a cap on 10-year bond yields) by keeping the 0.5% cap in place but indicating that it will now view this as a ‘reference’ and that it will tolerate yields as high as 1%. While the central bank appears to be cautiously embarking on monetary normalisation, the move seems to have been designed to change the policy without causing financial markets to fear that interest rates will soon rise. A gradual shift towards positive policy rates could prove beneficial for the Japanese yen, which has proved vulnerable to interest-rate changes in other economies.

Nevertheless, the BoJ signalled at its monetary-policy meeting in September that it was in no rush to end its ultra-low interest-rate policy, precipitating a sell-off in the currency.15 As Japan confronts persistently increasing prices and rising wages for the first time in decades, the BoJ and its Governor Kazuo Ueda will face a delicate balancing act in communicating and implementing any change in monetary strategy.

In stark contrast to its Western counterparts, China’s economy slipped into deflation in July, with the consumer price index falling by 0.3% year on year,16 highlighting the precarious nature of the country’s post-Covid recovery. The manufacturing sector has also experienced difficulties, with exports contracting by 8.8% in August compared with the previous year, as the worsening trade and geopolitical relationship with the US appeared to be having an adverse effect on trade.17

In efforts to restore confidence to the economy, China announced measures in late August to support the housing market, cutting mortgage interest rates and deposit requirements in an attempt to boost disposable income. In addition, the People’s Bank of China announced on 1 September that it would cut the amount of foreign currency that financial institutions are required to hold in reserve, as it sought to protect the renminbi from weakness versus the US dollar.18 However, without a more comprehensive policy response to stimulate activity, China’s 2023 growth target of 5% looks difficult to achieve.

Investment implications

In an update to G20 leaders in early September, Klaas Knot, chair of the Financial Stability Board, an international body that monitors and makes recommendations about the global financial system, warned of “further challenges and shocks” ahead as the effects of interest-rate rises are increasingly felt in economies.19

With the US and UK central banks keeping rates on hold at their September meetings, and the ECB lifting its deposit rate again but hinting that borrowing costs may have peaked, it seems likely that the major central banks are nearing the end of their rate-rising cycles. However, with inflation expectations still above target and labour markets looking tight, central bankers have remained hawkish in their rhetoric and appear set to maintain policy rates at a higher level for an extended period.

Headline inflation rates have been dropping as last year’s energy and food price shocks fade away, but core inflation may prove harder to curb as the costs of labour and services remain elevated. Labour markets have been affected by demographics, as the baby boomer generation retires, as well as greater protectionism, which has led to lower labour mobility. Geopolitical tensions and deglobalisation are also contributing to higher costs. From the 1990s onwards, China was an unlimited source of very low-cost, skilled manufacturing labour, the scale of which cannot easily be found elsewhere. India has a vast labour market, but the country’s comparative advantage in manufacturing is not as favourable as China’s was.

Although consensus had broadly shifted away from the likelihood of recession towards a ‘soft-landing’ scenario, the risk of monetary-policy error leading to a downturn remains real in our view, particularly in Europe and the UK where economies have already slowed much more rapidly than in the US – partly because the energy price shock has been much greater. Germany, for example, is likely to see three consecutive quarters of falling output. At the same time, China’s economy, while not contending with the same inflationary pressures, has been weakening sharply, as the immediate post-pandemic surge subsides and continuing issues with the housing market and debt deflation resurface.

Higher interest rates can typically take nine to 12 months to feed into the real economy, but in some cases this could be longer. In the UK, for instance, many consumers had taken out five-year fixed-rate mortgages in recent years, taking advantage of historically low interest rates, so higher rates may take longer to affect consumer spending. In addition, the combination of real wage strength and high household savings is likely to have delayed the impact of monetary tightening.

Interest rates (%)

Source: FactSet, October 2023.

Policymakers are also increasingly concerned about the impact of higher rates on key sectors such as real estate, as well as private equity businesses and hedge funds which may have borrowed extensively during the decade of cheap debt to fund their activities.

As evidence mounts that economies are slowing down and interest-rate rises are priced in, we believe developed-market government bonds will become increasingly attractive, both in terms of their potential to generate returns and for diversification purposes.

In addition, one notable feature of the last two years is how well certain emerging markets have dealt with inflation. In many cases, often in contrast to their developed counterparts, central banks across Asia and in parts of Latin America have been proactive and fiscal policy has been conservative, giving long-term investors comfort in these markets’ financial credibility. We are therefore finding pockets of opportunity in emerging-market bonds, although it will be critical to be selective and take account of currency factors.

Elsewhere, we believe careful security selection will be important when allocating to investment-grade corporate bonds, and in terms of high-yield credit we favour exposure to the US in view of the resilience of its consumers.

Higher interest rates and the prospects of a downturn are likely to prove challenging for global equity markets, as companies have to adjust to a higher cost of capital, increased earnings volatility, and in some cases uncertainty regarding the future of their business models. Nevertheless, opportunities will emerge for active investors, particularly in businesses with pricing power operating in areas supported by structural trends. Many stocks currently appear richly valued, but suitable entry points may appear during periods of downside volatility.

As geopolitical tensions increase, the realignment of supply chains is accelerating, with many Western companies diversifying their logistics away from China in particular. This can present attractive opportunities, especially for companies involved in areas such as semiconductors and the battery supply chain where governments have been offering fiscal subsidies for the building of new facilities. At the same time, as competition grows for crucial resources such as the rare earths used in the manufacture of various devices from smartphones to electric cars, companies with exposure to this area are likely to be in a strong position.

Elsewhere, the widespread adoption of artificial intelligence (AI) technologies should enable many companies that are directly or indirectly involved in their production to grow their earnings materially. However, picking the ultimate winners will be a difficult call at this stage, so being selective around how to gain exposure will be key.

Conclusion

After a rapid series of interest-rate rises in the US, euro area and UK over the last year, we appear to be approaching the peaks. However, while headline inflation has fallen over recent months, core inflation has remained persistent as the costs of labour and services remain high, and hawkish central banks have suggested that rates are set to plateau for a period rather than descend any time soon.

With monetary tightening having a significant lag before fully feeding into the global economy, it is likely that its effects will weigh further on economic activity over the rest of the year. The US economy has remained surprisingly resilient, but Europe is now showing significant signs of weakening. Meanwhile, China, previously a key driver of global growth, faces a different set of domestic economic challenges, as well as worsening geopolitical and trade tensions with the US and its allies.

Nevertheless, structural demand trends remain in place, as many global shifts – from technology to supply-chain realignment and climate adaptation – continue apace, supported in some cases by government stimulus and support.

Against this complex backdrop, we think there is likely to be an increasing dispersion of performance between different asset classes, sectors and securities, which we believe underscores the importance of taking an active investment approach.

To aim for the highest point is not the only way to climb a mountain.

Nan Shepherd, writer and poet, 1893-1981

1 Jay Powell warns inflation ‘too high’ in Jackson Hole speech, Financial Times, 25 August 2023

2 September 20, 2023: FOMC Projections materials (federalreserve.gov)

3 Speech by Christine Lagarde, President of the ECB, at the Hearing of the Committee on Economic and Monetary Affairs of the European Parliament, 25 September 2023 (ecb.europa.eu)

4 Source: FactSet, 1 October 2023

5 Bond market returns sourced from FactSet, 1 October 2023

6 Equity market returns sourced from FactSet, 1 October 2023 (All sterling total returns, FTSE World Index)

7 Gold bullion returns sourced from FactSet, 1 October 2023

8 US jobs data raises hope of Goldilocks scenario as economy cools, Financial Times, 1 September 2023

9 US inflation rises in August as petrol prices jump, Financial Times, 13 September 2023

10 UK economy makes stronger recovery from pandemic than previously estimated, Financial Times, 29 September 2023

11 Bank of England holds interest rates at 5.25%, Financial Times, 21 September 2023

12 UK wages grow at 7.8% despite slowing jobs market, Financial Times, 12 September 2023

13 Euro hits six-month low and investors bet against more interest rate rises after release of PMIs, Financial Times, 22 September 2023

14 Can Germany fix its economy?, Financial Times, 20 August 2023

15 Yen tumbles after Bank of Japan maintains ultra-low interest rates, Financial Times, 22 September 2023

16 Chinese economy falls into deflation as recovery stumbles, Financial Times, 9 August 2023

17 China’s renminbi hits 16-year low after exports tumble in August, Financial Times, 7 September 2023

18 China boosts housing market and renminbi support, Financial Times, 1 September 2023

19 Global financial watchdog warns of ‘further challenges and shocks’ ahead, Financial Times, 5 September 2023

All data is sourced from FactSet unless otherwise stated. All references to dollars are US dollars unless otherwise stated.

These opinions should not be construed as investment or other advice and are subject to change. This document is for information purposes only. This is not investment research or a research recommendation for regulatory purposes. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell investments in those securities, countries or sectors. Issued in the UK by Newton Investment Management Limited, The Bank of New York Mellon Centre, 160 Queen Victoria Street, London, EC4V 4LA. Registered in England No. 01371973. Newton Investment Management Limited is authorised and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN and is a subsidiary of The Bank of New York Mellon Corporation. This material may be distributed by BNY Mellon Investment Management EMEA (BNYM IM EMEA) in the UK to professional investors. BNYM IM EMEA, BNY Mellon Centre, 160 Queen Victoria Street, London EC4V 4LA. Registered in England No. 1118580. ‘Newton’ and/or ‘Newton Investment Management’ is a corporate brand which refers to the following group of affiliated companies: Newton Investment Management Limited (NIM), Newton Investment Management North America LLC (NIMNA) and Newton Investment Management Japan Limited (NIMJ). NIMNA was established in 2021 and NIMJ was established in March 2023. This material is for Australian wholesale clients only and is not intended for distribution to, nor should it be relied upon by, retail clients. This information has not been prepared to take into account the investment objectives, financial objectives or particular needs of any particular person. Before making an investment decision you should carefully consider, with or without the assistance of a financial adviser, whether such an investment strategy is appropriate in light of your particular investment needs, objectives and financial circumstances. Newton Investment Management Limited is exempt from the requirement to hold an Australian financial services licence in respect of the financial services it provides to wholesale clients in Australia and is authorised and regulated by the Financial Conduct Authority of the UK under UK laws, which differ from Australian laws. Newton Investment Management Limited (Newton) is authorised and regulated in the UK by the Financial Conduct Authority (FCA), 12 Endeavour Square, London, E20 1JN. Newton is providing financial services to wholesale clients in Australia in reliance on ASIC Corporations (Repeal and Transitional) Instrument 2016/396, a copy of which is on the website of the Australian Securities and Investments Commission, www. asic.gov.au. The instrument exempts entities that are authorised and regulated in the UK by the FCA, such as Newton, from the need to hold an Australian financial services license under the Corporations Act 2001 for certain financial services provided to Australian wholesale clients on certain conditions. Financial services provided by Newton are regulated by the FCA under the laws and regulatory requirements of the United Kingdom, which are different to the laws applying in Australia.