Since developer OpenAI’s ChatGPT chatbot captured people’s attention following its public release in late 2022, the topic of artificial intelligence (AI) has never been far from the headlines, generating both huge excitement and deep concern. In recent weeks, it has been reported how AI is being used to discover new antibiotics,1 create a new Beatles song,2 and generate audio commentary for the Wimbledon tennis championships.3 Elsewhere, with AI presenting a potential threat to large numbers of jobs, even Hollywood actors have raised concerns about being replaced in films and TV shows without proper permissions or payment.4 Meanwhile, acknowledging the risks as well as the upsides of the technology, the founders of OpenAI signalled that AI may eventually require an international regulator equivalent to the International Atomic Energy Agency.5

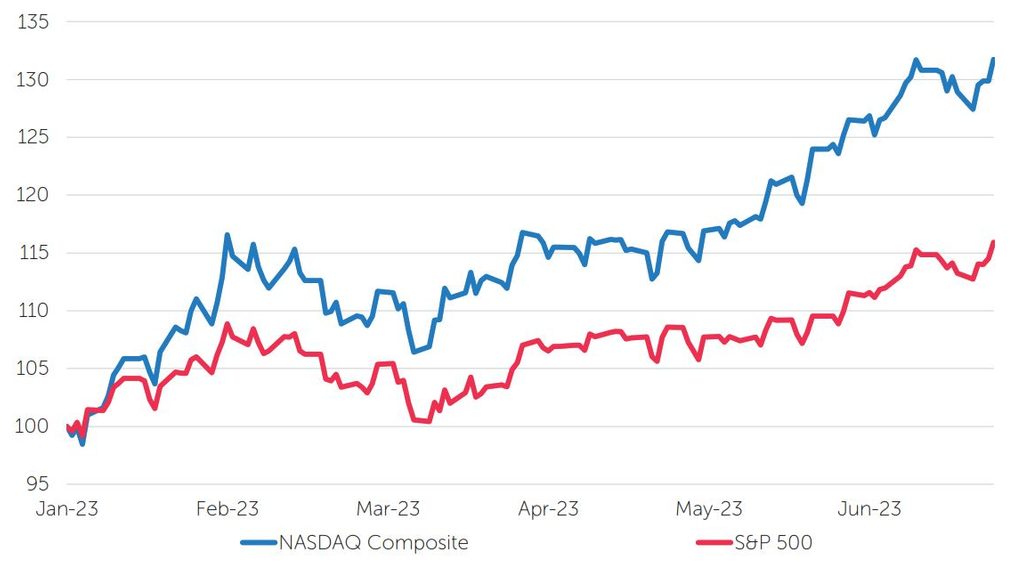

During the second quarter of 2023, financial-market participants continued to drive a rally in the large US technology companies that are expected to benefit from the growth of AI. The Nasdaq Composite Index, which is heavily weighted towards companies in the information technology sector, rose by 12.8% during the quarter, cementing a gain of almost 32% for the first half of the year, nearly twice that of the broader S&P 500 Index over the same period.6

S&P 500 Index and Nasdaq Composite Index

Price (US$), rebased to 100 at 31.12.22

Source: FactSet, July 2023.

On a regional basis, the Japanese equity market was the strongest performer in local-currency terms. After years of stagnation, the country is starting to see higher inflation and a rebounding economy. In addition, recent policy actions by the Japanese government have sought to improve corporate governance and foster more shareholder-friendly behaviours.

A number of other tailwinds helped support equity markets during the quarter. US consumer price inflation showed further signs of easing in May, rising by 4%, its lowest annual increase in more than two years.7 Investors were also encouraged by a seemingly resilient US economy, with over 600,000 non-farm jobs being added during April and May,8 well ahead of forecasts and reinforcing the ‘soft-landing’ narrative as consumer spending remained strong. In addition, US corporate earnings for the first quarter, while declining for the second successive three-month period, came in significantly ahead of analysts’ expectations, diminishing some concerns about the need for a significant adjustment to 2023 consensus estimates.

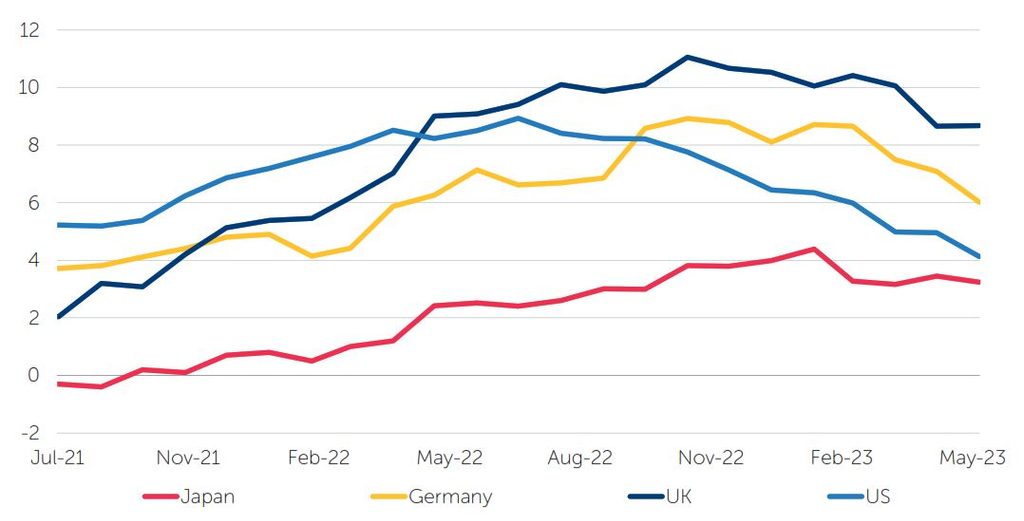

Nevertheless, there was also plenty for market participants to worry about. A key issue was the future trajectory of interest rates, as core inflation (excluding food and energy) threatened to remain elevated despite easing headline figures. While the US Federal Reserve (Fed) opted to leave rates unchanged in June, Fed Chair Jay Powell indicated that two further interest-rate rises were likely this year,9 putting further pressure on the economy. The European Central Bank (ECB) maintained similarly hawkish messaging, raising rates by 0.25% again in June and signalling it would do the same in July, as it warned that the battle against inflation was far from over.10 The Bank of England, meanwhile, surprised markets in June with a 0.5% rate increase as the May inflation print came in higher than expected at 8.7%, well above readings in the US and continental Europe.11

In China, the strength of the post-Covid recovery was called into question, with various economic indicators, such as retail sales and investments, weaker than expected as the country’s beleaguered property sector in particular has remained a drag on the economy.

After making gains in the first three months of the year, the recovery in fixed-income markets stalled in the second quarter as interest-rate rises remained on the agenda, and 10-year US Treasury yields (which move inversely to prices) were up 31 basis points to 3.81%. Gilts, as represented by the FTSE Actuaries UK Conventional Gilts All Stocks Index, suffered given the UK’s stubborn inflation, and returned -5.4% over the quarter (-3.5% over the six months to 30 June), while overseas government bonds, as represented by the JP Morgan Global Government Bond Index (excluding the UK), produced a return of -4.9% in sterling terms (-4.7% over six months). Corporate bonds, as represented by the ICE BofA Sterling Non-Gilt Index, returned -3.4% over the quarter (-1.0% over the year to date).12

Most major equity markets made positive local-currency returns over the three-month period, although sterling’s strength meant these were more muted for UK-based investors. North American equities returned +5.5% over the quarter (+10.4% over six months) in sterling terms, while Japanese stocks returned +3.0% (+6.4% over the year to date). Meanwhile, Europe ex UK equities delivered a smaller but still positive return of +0.6% (+9.3% over six months) in sterling terms, UK equities declined by -0.5% (+2.6%), and Asia Pacific ex Japan equities fell by -1.7% over the quarter (+0.9% over six months). Finally, emerging-market equities returned -1.9% (-1.7% over the year to date) to UK-based investors.13

Gold delivered a negative return of -2.6% in US-dollar terms over the quarter (+5.2% over the year to date), while in sterling terms the precious metal produced a negative return of -4.9% (+0.7%).14

At the start of June, the US Senate approved a fiscal deal to raise the country’s debt ceiling, ending a long political stand-off that threatened to trigger a historic debt default in the world’s biggest economy. As part of the deal, non-defence fiscal spending will be capped in 2024 and 2025, although spending cuts appear unlikely to have a significant impact on the economy in the near term. However, the deal means the US Treasury will be looking to replenish its balances at the Fed, primarily through increased issuance, which could serve to tighten liquidity and may negatively affect bank reserves.

Although there was no repeat of the turmoil seen in March, the US regional banking sector remained under pressure during the quarter as regulators speedily arranged for First Republic Bank to be rescued by JPMorgan Chase, wiping out its shareholders in the second-biggest bank failure in the country’s history. The collapse of First Republic highlights how banks that relied on low-cost deposits have become exposed in a higher interest-rate environment.

The banking crisis may have been a factor in the Fed’s decision to hold off raising rates in June, but with both inflation and growth projections revised upwards at the June meeting, the Federal Open Market Committee’s latest ‘dot plot’ projection is predicting two further quarter-point hikes this year, increasing the potential for ‘breakages’ in other vulnerable sectors.

In the UK, thousands braved the rain in London and millions more turned on their TVs to celebrate the coronation of King Charles III on 6 May. There was little, however, to celebrate for the millions of households seeking to remortgage this year, as financing costs rose sharply ahead of the Bank of England’s decision to raise interest rates in June in an attempt to restore its credibility in the fight against inflation.

Speaking in May, Bank of England Governor Andrew Bailey admitted that the UK had been experiencing “second-round” inflationary effects, as higher energy and food prices have led to persistent wage growth and price increases by companies, risking a wage-price spiral.15 The UK appears more vulnerable to such a development than the US or European Union (EU), as it is more reliant on food and energy imports and its labour market has been constrained by post-Brexit rules.

While the UK’s economic outlook has recently improved,16 thanks in large part to falling energy prices, consumer confidence is likely to be hampered by rising mortgage costs and other inflationary pressures for the remainder of the year.

Consumer price inflation

% change year on year

Source: FactSet, July 2023.

In Europe, Germany closed the last of its nuclear power stations in April.17 Despite the continuing energy crisis as a result of the Russia-Ukraine conflict, the government believes nuclear power is unsustainable and will distract from a focus on renewable-energy production, while opponents view the closures as ill-advised at a time when sources of low-carbon energy are urgently needed.

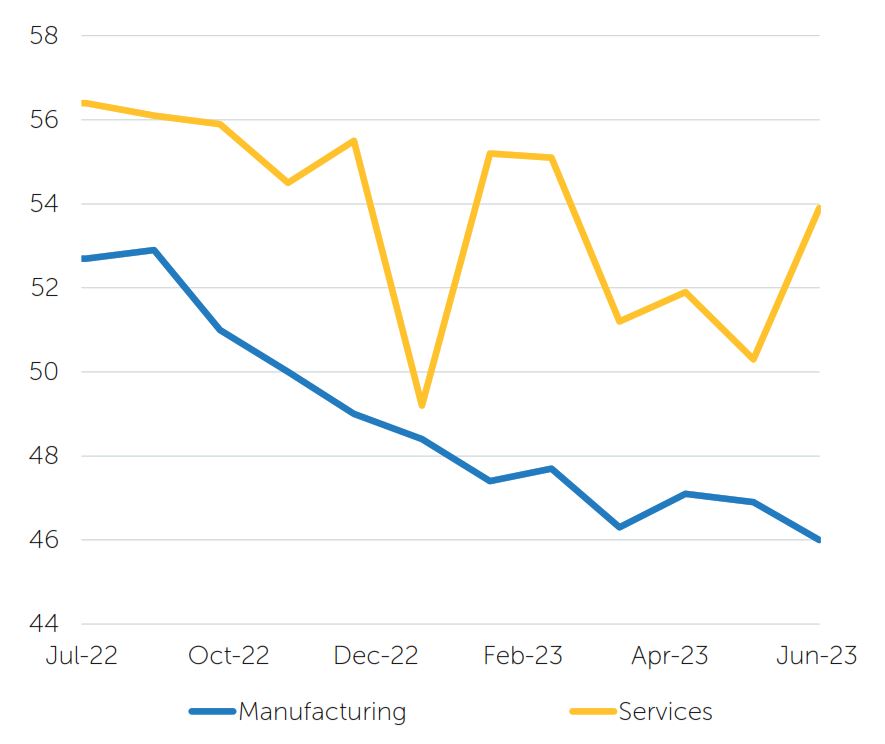

Germany’s economy appeared to need an energy boost, as its federal statistical agency reported that gross domestic product (GDP) had declined by 0.3% during the first quarter, lagging many of its European counterparts. The country has experienced weakness in its important manufacturing sector, while consumption fell 1.2% from the previous quarter as consumers have been hit by increasing borrowing costs and rising inflation.18

While the eurozone economy has remained weak, with GDP shrinking slightly for the last two quarters, the labour market has remained resilient, with ECB President Christine Lagarde describing its strength as “incredible”. She also asked governments to promptly roll back the fiscal support launched during the energy crisis, to avoid pushing up inflation that would ultimately require an even stronger monetary-policy response.

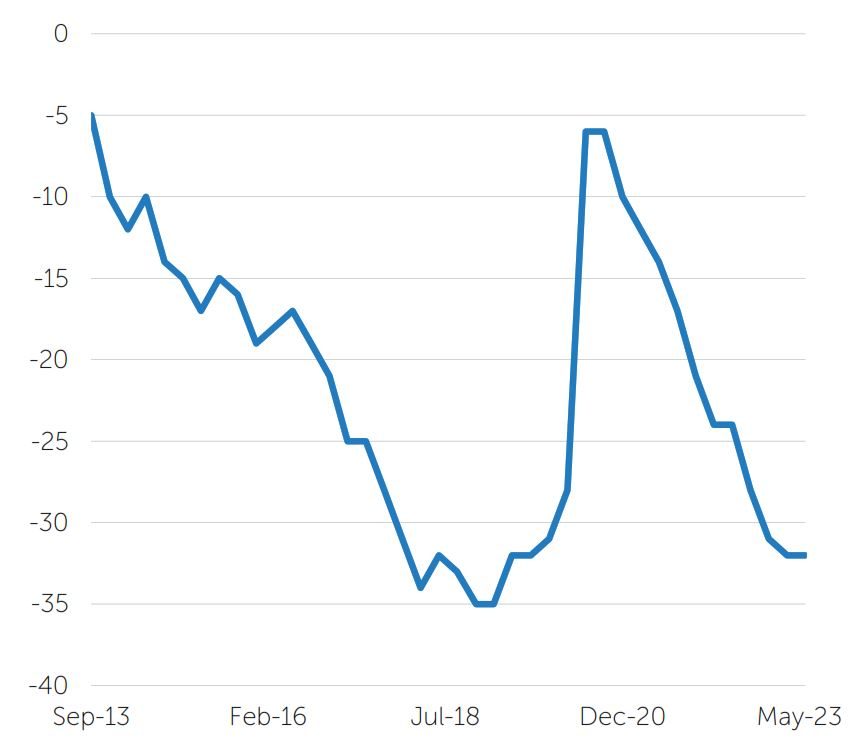

The rekindling of Japan’s economy is evident in the resurgence of wage inflation. The Bank of Japan’s (BoJ) quarterly Tankan survey of economic conditions is highlighting how companies are finding it increasingly difficult to find labour, forcing them to offer higher wages and improved benefits. The annual ‘shunto’ wage negotiations between unions and major companies this spring saw the highest wage increases in over 30 years, with the growth in base salaries (excluding automatic wage increases based on seniority) reaching 2.3%, compared with 0.5% a year earlier.19

Japan Tankan employment conditions – all enterprises, all industries

Source: FactSet, July 2023.

Business sentiment for both services and manufacturers rose in June compared to three months previously, with sentiment among large Japanese manufacturers improving for the first time since 2021, as the costs of raw materials started to fall. Meanwhile, large companies plan to boost capital expenditure by 13.4% in the current fiscal year.20 Core inflation has remained above the BoJ’s target, and its ‘core-core’ index that excludes fresh food and fuel rose by 4.3% in May, the biggest annual increase since June 1981.21

Against this backdrop, the BoJ looks set to become more hawkish over time. It seems likely that the policy of yield-curve control – which has resulted in enormous distortion of the Japanese government-bond market – could be abandoned later this year.

The People’s Bank of China cut its main policy rate in June as data continued to show that the post-Covid rebound was faltering. Retail sales increased by 12.7% from the prior year in May 2023, although they were down from 18.4% in April and missed expectations.22 The property sector, which was an important source of growth across the economy before the pandemic, has remained weak, with real-estate investment falling by 7.2% between January and May, compared with the same period in 2022.23 The sector’s malaise has dragged down related industries such as construction, and consumers remain reluctant to invest after a number of developers went into default during the pandemic. Exports also fell significantly in April.

Further stimulus in addition to rate cuts is likely to be required if China is to reach the 5.0% growth target it has set for this year. This could include infrastructure spending, tax breaks for consumers, or providing property developers with assistance to help them complete unfinished real-estate projects.

The rise of AI could be the worst or the best thing that has happened for humanity.

Stephen Hawking, theoretical physicist, 1942-2018

1 Scientists use AI to discover new antibiotic to treat deadly superbug, The Guardian, 25 May 2023

2 Sir Paul McCartney says artificial intelligence has enabled a ‘final’ Beatles song, BBC News, 13 June 2023

3 Wimbledon to use AI for video highlight commentary, CNN, 21 June 2023

4 A.I. worries Hollywood actors as they enter high-stakes union talks, CNBC, 7 June 2023

5 Governance of superintelligence, OpenAI, 22 May 2023 (https://openai.com/blog/governance-of-superintelligence)

6 Source: FactSet, 1 July 2023

7 Pace of US inflation eases to slowest in over two years, Financial Times, 13 June 2023

8 Source: FactSet, 1 July 2023

9 Federal Reserve skips rate rise but signals two more increases on the way, Financial Times, 14 June 2023

10 ECB increases interest rates to highest level since 2001, Financial Times, 15 June 2023

11 Bank of England raises interest rates by 0.5 percentage points, Financial Times, 22 June 2023

12 Bond market returns sourced from FactSet, 1 July 2023

13 Equity market returns sourced from FactSet, 1 July 2023 (All sterling total returns, FTSE World Index)

14 Gold bullion returns sourced from FactSet, 1 July 2023

15 Bank of England governor says the UK is facing a wage-price spiral, CNBC, 18 May 2023

16 UK economy returns to growth driven by consumer spending, Financial Times, 14 June 2023

17 ‘A new era’: Germany quits nuclear power, closing its final three plants, CNN, 15 April 2023

18 Fall in German GDP increases threat of sustained recession in EU’s largest economy, Financial Times, 25 May 2023

19 Source: CEIC, MHLW Haver, Morgan Stanley Research, 5 April 2023

20 Improving Japan business mood signals steady economic recovery, Reuters, 3 July 2023

21 Japan’s inflation stays above BOJ target, key gauge hits 42-year high, Reuters, 23 June 2023

22 Chinese economic data fuels gloom over recovery, Financial Times, 15 June 2023

23 China’s economic recovery is spluttering. The prognosis is not good, The Economist, 22 June 2023

All data is sourced from FactSet unless otherwise stated. All references to dollars are US dollars unless otherwise stated.

These opinions should not be construed as investment or other advice and are subject to change. This document is for information purposes only. This is not investment research or a research recommendation for regulatory purposes. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell investments in those securities, countries or sectors. Issued in the UK by Newton Investment Management Limited, The Bank of New York Mellon Centre, 160 Queen Victoria Street, London, EC4V 4LA. Registered in England No. 01371973. Newton Investment Management Limited is authorised and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN and is a subsidiary of The Bank of New York Mellon Corporation. This material may be distributed by BNY Mellon Investment Management EMEA (BNYM IM EMEA) in the UK to professional investors. BNYM IM EMEA, BNY Mellon Centre, 160 Queen Victoria Street, London EC4V 4LA. Registered in England No.1118580. ‘Newton’ and/or ‘Newton Investment Management’ is a corporate brand which refers to the following group of affiliated companies: Newton Investment Management Limited (NIM), Newton Investment Management North America LLC (NIMNA) and Newton Investment Management Japan Limited (NIMJ). NIMNA was established in 2021 and is comprised of the equity and multi-asset teams from an affiliate, Mellon Investments Corporation. NIMJ was established in March 2023 and is comprised of the Japanese equity management division of an affiliate, BNY Mellon Investment Management Japan Limited. This material is for Australian wholesale clients only and is not intended for distribution to, nor should it be relied upon by, retail clients. This information has not been prepared to take into account the investment objectives, financial objectives or particular needs of any particular person. Before making an investment decision you should carefully consider, with or without the assistance of a financial adviser, whether such an investment strategy is appropriate in light of your particular investment needs, objectives and financial circumstances. Newton Investment Management Limited is exempt from the requirement to hold an Australian financial services licence in respect of the financial services it provides to wholesale clients in Australia and is authorised and regulated by the Financial Conduct Authority of the UK under UK laws, which differ from Australian laws. Newton Investment Management Limited (Newton) is authorised and regulated in the UK by the Financial Conduct Authority (FCA), 12 Endeavour Square, London, E20 1JN. Newton is providing financial services to wholesale clients in Australia in reliance on ASIC Corporations (Repeal and Transitional) Instrument 2016/396, a copy of which is on the website of the Australian Securities and Investments Commission, www. asic.gov.au. The instrument exempts entities that are authorised and regulated in the UK by the FCA, such as Newton, from the need to hold an Australian financial services license under the Corporations Act 2001 for certain financial services provided to Australian wholesale clients on certain conditions. Financial services provided by Newton are regulated by the FCA under the laws and regulatory requirements of the United Kingdom, which are different to the laws applying in Australia.