Economic and market background

On 18 December, following weeks of intense seismic activity, a volcano on the Reykjanes peninsula of southwest Iceland erupted. Large quantities of lava and smoke were ejected across a wide area, creating a spectacular, red- lit backdrop which could be seen from Iceland’s capital Reykjavik some 25 miles away. Financial markets, meanwhile, after coming under significant pressure during the second half of the summer and October, were reignited during the final few weeks of the year as hopes for an economic soft landing gathered pace, with a notable easing of financial conditions supported by a disinflationary narrative and increasingly dovish rhetoric from the US Federal Reserve (Fed).

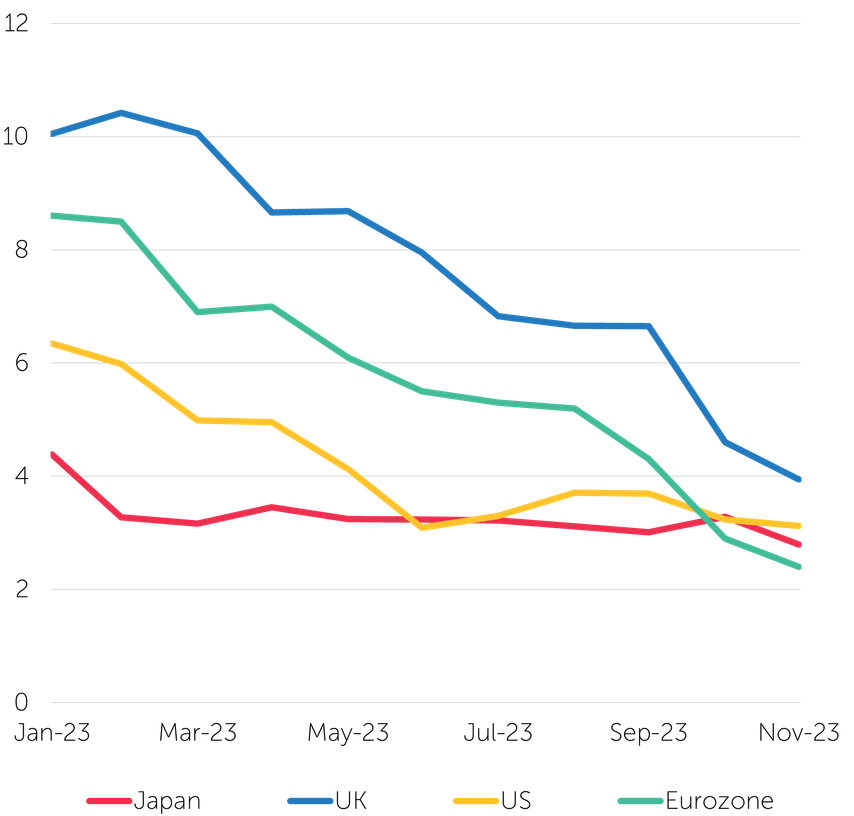

Headline US consumer price inflation resumed its downward trend to 3.2% (year on year) in October and 3.1% in November.1 signalling to market participants that the Fed remained on track in its efforts to return inflation to its 2% target. In the eurozone, consumer price inflation fell for the third successive month in November to 2.4%,2 while the annual rate of increase in the UK’s consumer prices dropped to 3.9% in November from 4.6% in the previous month.

As the Fed’s final interest rate-setting meeting of the year approached, expectations of a pivot gained momentum when previously hawkish Fed Governor Christopher Waller indicated in late November that, should the decline in inflation continue for several more months, rate cuts could be on the agenda to keep policy from becoming overly tight.3 Market sentiment was also bolstered by evidence that the US economy remained resilient, with gross domestic product (GDP) growing at an annualised rate of 5.2% in the third quarter.4

In the event, the December meeting of the Fed’s Federal Open Market Committee (FOMC) proved even more dovish than many had anticipated. As the federal funds rate was left unchanged at 5.25-5.5%, Fed Chair Jerome Powell, while not ruling out further rate rises, indicated that the tightening cycle was likely to be over, stating that rate increases were “not the base case anymore”.5 With the FOMC observing that “growth of economic activity has slowed from its strong pace in the third quarter”, while “inflation has eased over the past year but remains elevated”, there was a marked shift in the outlook, with 17 of the 19 policymakers expecting rates to be lower by the end of 2024, and none seeing them higher.6 Notably, the committee’s ‘dot plot’ projections forecast three rate cuts in 2024.

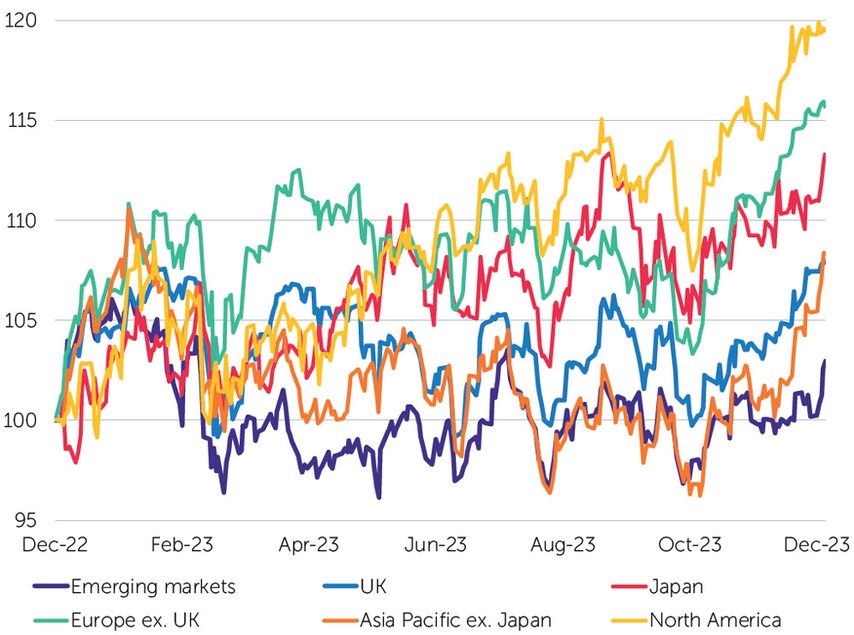

While equity markets experienced significant downside volatility in October as the tragic events witnessed in the Middle East contributed to an increase in risk aversion, the sharp rally during November and December resulted in all major markets posting positive quarterly returns. The S&P 500 index of US stocks delivered a nine-week winning streak – its longest since 2004 – to end the quarter up 11% and the calendar year up 24%. Most other equity markets ended the year firmly in positive territory, although China was a notable underperformer, in the face of its lacklustre post-pandemic lockdown recovery.

After US 10-year Treasury yields breached 5% in October – a level not seen since 2007, bond markets staged a very strong recovery during the last two months of the year, with yields (which move inversely to prices) falling across the globe. Gold also gained more than 11% in US-dollar terms during the final quarter, with the precious metal experiencing its best year since 2020.

Equity markets

Total returns (£), rebased to 100 at 31.12.22

Note: all indices are FTSE series.

Source: FactSet, January 2024.

Total returns (%) to 31 December 2023

| Asset class | Index | 3 months | 12 months |

| UK equities | FTSE All-Share | +3.2 | +7.9 |

| North American equities | FTSE World North America (£) | +7.1 | +19.4 |

| European ex UK equities | FTSE World Europe ex UK (£) | +7.6 | +15.7 |

| Japanese equities | FTSE Japan (£) | +3.3 | +13.3 |

| Asia-Pacific ex Japan equities | FTSE World Asia Pacific ex Japan (£) | +8.5 | +8.3 |

| Emerging-market equities | FTSE All-World Emerging (£) | +2.1 | +2.9 |

| UK gilts | FTSE Actuaries UK Conventional Gilts All Stocks | +8.1 | +3.7 |

| Corporate bonds | ICE BofA Sterling Non-Gilt | +7.4 | +8.6 |

| Overseas government bonds | JP Morgan Global Government Bond (ex UK) (£) | +2.9 | -2.1 |

| Gold (US$) | Gold ($/ozt SIX) | +11.7 | +13.2 |

| Gold (£) | Gold (£/ozt SIX) | +7.0 | +7.6 |

Source: FactSet, 1 January 2024. All equity market returns are sterling total returns.

Regional overview

While headline US inflation has continued to fall, the ‘core’ measure, which excludes more volatile energy and food prices, and which is often seen as a guide for longer-term inflation, showed signs of remaining sticky, rising by 0.3% during November and remaining flat at 4.0% year on year. Meanwhile, the monthly employment report published by the Bureau of Labor Statistics on 8 December showed continued resilience in the economy. Average hourly earnings grew by 0.4% compared to the previous month, ahead of consensus expectations.7 In addition, job growth has continued to be strong, with non-farm payrolls increasing by 199,000 in November, while the unemployment rate fell from 3.9% to 3.7%. Nevertheless, the country’s labour market appears gradually to be cooling. Revised data showed that the economy added 35,000 fewer jobs in September than previously estimated, while November’s employment gains were below the monthly average of 240,000 over the last year.8

US non-farm payrolls

Change, thousands

Source: FactSet, January 2024

In contrast to her US counterpart’s dovish tone, European Central Bank (ECB) President Christine Lagarde highlighted at the bank’s December meeting, at which interest rates were held at 4%, that she believed inflation would soon rebound and price pressures remained strong, largely driven by wage costs. Lagarde suggested that rates would be maintained at current levels for some time and stated that policymakers “did not discuss rate cuts at all”. Nevertheless, markets were still pricing in some 1.5% of cuts in 2024.9

Economic activity in the euro area has continued to be weak, with the region’s economy shrinking by 0.1% during the third quarter of 2023 and expected to have grown by only 0.6% in the year as a whole, as it has faced low export growth and tight financing conditions. The ECB has also downgraded its growth forecast for 2024, with GDP growth expected to remain subdued at 0.8%.10 Germany, the bloc’s biggest economy, has been hit particularly hard, with its large manufacturing sector strongly reliant on exports, while its government has been forced to cut back on spending following a court ruling that enforced a deficit cap. This has led to a reduction in subsidies for the energy transition.

According to the UK’s Office for National Statistics, the country’s GDP contracted by 0.1% in the third quarter, indicating that it could already be in recession. However, separate data for retail sales presented a more positive picture, showing that sales increased by 1.3% in November, boosted by Black Friday promotions.11

At its December meeting, the Bank of England’s (BoE) Monetary Policy Committee held rates at 5.25% and suggested that rates would need to remain high for “an extended period”, with the BoE’s Governor Andrew Bailey saying it was “really too early” to speculate about rate cuts.12 The BoE noted that wage inflation remained significantly higher than in either the US or the eurozone, and that services price inflation was not yet on an obvious downward trajectory. With bond yields having fallen significantly during the final weeks of the year, lower borrowing costs could support growth, while proposed government tax cuts may also boost GDP.

With the expectation of rising interest rates, Japan’s government announced cuts to its annual budget for the first time in 12 years as it sought to limit bond issuance and curb future interest payments. Over recent years the country’s public debt has risen to be more than double the size of the economy, as an extended period of ultra-low interest rates enabled successive rounds of fiscal stimulus.13

While the Bank of Japan maintained its monetary policy settings at its December meeting,14 a large majority of economists expect it to end its negative interest-rate policy in 2024, following a relaxation of the government bond yield cap during 2023. Inflation has remained at above 2% for more than a year, and several big companies have signalled that they will continue to increase wages in 2024. Consumer spending has been strong, although has recently shown signs of softening.

The International Monetary Fund (IMF) upgraded its 2023 growth forecast for China in November, after the Chinese government approved a 1 trillion yuan (US$137 billion) sovereign bond issue and passed a bill to allow indebted local governments to frontload part of their 2024 bond quotas. The IMF estimates the economy will now grow by 5.4% in 2023, although continued weakness in the country’s property sector and subdued external demand could limit growth in 2024.15

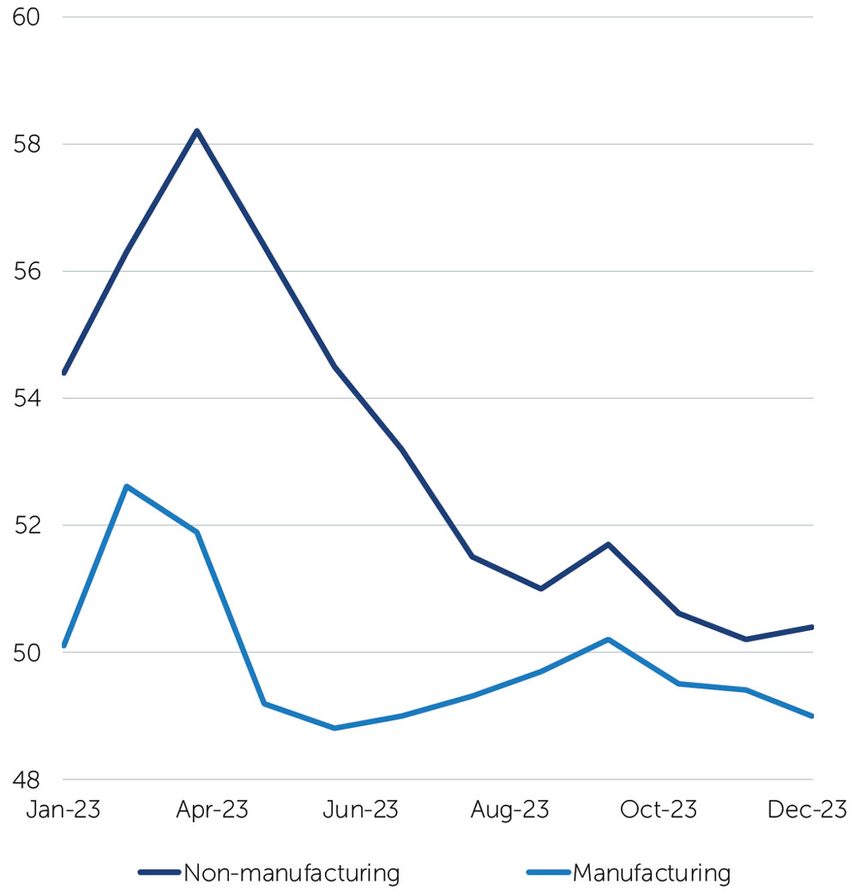

China’s official purchasing managers’ indices have painted a challenging picture, with manufacturing activity shrinking for a third consecutive month in December, and consumer prices falling by 0.5% in November, compared with the previous month. Conversely, the non-manufacturing purchasing managers’ index, which includes services and construction, rose to 50.4 in November, supported by a recovery in the services sector.16

China purchasing managers’ indices

Source: FactSet, January 2024.

Investment implications

2024 looks set to be the third year of a new market regime – one that remains volatile and difficult to predict, with stubborn inflation (albeit lower than in 2023) and fears of economic slowdown. These factors will continue to influence markets, along with changing interest-rate trends and geopolitical developments.

Market participants’ obsession with whether a soft landing or recession will occur is likely to continue; for now, the soft- landing camp appears to have the upper hand. Investors who have been concerned about inflation on the one hand and economic contraction on the other may welcome a scenario that places economics firmly in the middle. In our view, an economic slowdown that significantly increases unemployment remains probable owing to the cumulative effects of higher interest rates and higher costs which will gradually undermine investment and consumer spending. The soft-landing scenario could gradually morph into a hard landing.

One of the key trends that will shape this economic debate is the continued evolution of trade. The era of deglobalisation is becoming one of ‘reglobalisation’ in which new trade relationships are being established: less trade between US and China, and more trade within Asia and between other Asian countries and the US. In 2023, financial-market participants misjudged the positive influence of fiscal spending that counteracted tighter monetary policy; in 2024, it could be that they underestimate the benefits of new trade deals and investment spending between countries. This could dampen the negative effects of a sharp slowdown in the US and Europe and also help economies in those regions to bounce back quickly once their central banks are able to cut rates.

A major influence on economies and markets in 2023 was that very significant rise in government spending, particularly in the US, which helped to offset the effects of tighter monetary policy. In the US, this spending splurge looks set to continue during 2024, but will be less extensive. Elsewhere, it is increasingly obvious that governments have run out of money. In Europe there are some untapped funds available, but they look set to be swallowed up as economies slow. A dip in tax revenues and an increase in social spending are likely consequences of an economic slowdown that will push up government deficits and the share of government spending in GDP statistics. ‘Big government’ is here to stay, but the next phase may be less about investment-led spending and more about economic support. This means that the bond markets of Europe and the US will have more supply to digest. If central banks cut interest rates, this should not be a problem; difficulties are likely to resurface when economies, and therefore inflation, are bouncing back.

To work out the direction of interest rates, investors may spend the first part of the year studying employment reports to see if central banks will need to cut rates sharply or keep them where they are. Significant thematic changes to employment have made the task of job analysis difficult. There are large distortions in the data relating to people wanting or able to work, as well as slower migration flows which are ultimately raising employment costs for companies and making them reluctant to let people go. Artificial intelligence and robotics may provide part of the solution for some businesses, but initial capital costs could push inflation higher than it otherwise would have been before the benefits of automation come through.

One constant in 2024 is likely to be heightened geopolitical risk. This is always a difficult area for investors to predict or even adapt to, and as a result is often ignored until the consequences become serious. Political uncertainty is likely to dominate investors’ plans in the UK and the US, where forthcoming elections could lead to a change in government and thereby a change in fiscal policy. This uncertainty could limit investment spending until the results and new government policies are more fully known, but equally could accelerate spending plans in certain areas before the existing government gravy train is taken away. There is widespread dissatisfaction with incumbent governments, which could lead to swings from one side to another. Promises of increased spending and tax cuts may ultimately be proved false as many governments have reached their limits on borrowing – limits which are applied by the governments themselves or which will be based on the market’s capacity to accept increased supply.

Another long-term trend that has recently been given fresh impetus is the energy transition away from fossil fuels. To achieve ambitious targets, investment spending on the transition looks set to rise at an accelerating pace over the next few years. This will be partially influenced by governments, although, with fewer incentives on offer, the approach could be more stick than carrot in future. Maintaining the necessary momentum and investing in alternatives is likely to be capital-intensive and, at the margin, inflationary.

While many of the trends for 2024 appear set to stoke inflation, the first few months of the year should continue to see a decline in headline figures, partly as payback for the significant rises over the prior 12 months, but also owing to the gradual economic slowdown. After that, and if economic growth gets back on track, the base level of inflation is likely to be higher than in the previous decade. Although trade volumes have been growing, they are now often driven primarily not by the lowest cost but by perceived security. Staff costs will remain higher than before owing to shortages. Government involvement in economies tends to be more inefficient and therefore more costly. Finally, increased defence spending tends to waste resources and divert capital into less productive areas.

Consumer price inflation

% change, year on year

Source: FactSet, January 2024

Overall, we anticipate significant divergence between countries and regions over the next 12 months as different countries will have different inflation and economic prospects, leading to variations in interest rates and corporate performance. The US, Europe and the UK remain vulnerable to economic weakness which may prove short-lived, while there may be mixed fortunes for Asian and Latin American economies.

Bond investors should enjoy the potential for central banks to lower rates, but at times are likely to be held back by high levels of supply and a higher inflation base. While high government issuance looks set to be a constant throughout the year, increased issuance by companies looks probable in the early part of the year to lock in some lower borrowing costs. To compensate for the uncertainty of inflation and the high levels of issuance, real yields (the return premium over inflation) should be positive.

Slower economic growth can be good news for equity markets as long as it takes the pressure off central banks to raise rates. Growth that becomes too slow, however, can bring about fears of declining profits and, if central banks are slow to react, can lead to a rise in bankruptcies.

Conclusion

As we enter 2024, the investment backdrop remains volatile and uncertain. Although headline inflation has declined significantly in recent months, price pressures are likely to remain as a result of structural factors that include changing trading patterns, labour shortages and higher government spending. Furthermore, while a recession has so far been avoided, the mounting effects of higher interest rates and financing costs are likely to weigh further on economic activity during the course of the year.

Investors must also continue to contend with heightened geopolitical risk, as exemplified by the conflicts in Ukraine and the Middle East, and political uncertainty, as elections approach in the US, the UK and other countries.

In this challenging environment, it will be important for investors to identify the long-term growth opportunities in areas supported by structural demand, such as artificial intelligence and the energy transition.

Given the likelihood of a growing dispersion of performance between different regions, asset classes and securities, we believe the case for an active investment approach is stronger than ever.

The world is full of foolish gamblers, and they will not do as well as the patient investors.

Charlie Munger, investor, 1924-2023

1 Rise in US core inflation highlights stubborn price pressures, Financial Times, 12 December 2023.

2 Euro zone inflation tumble pits ECB against markets, Reuters, 30 November 2023.

3 Fed policymakers parse inflation data for signals on rate path, Reuters, 29 November 2023.

4 US economy grows 5.2% in third quarter; higher interest rates eroding momentum, Reuters, 29 November 2023.

5 With rate hikes likely done, Fed turns to timing of cuts, Reuters, 13 December 2023.

6 December 12-13, 2023 FOMC meeting, federalreserve.gov.

7 Rise in US core inflation highlights stubborn price pressures, Financial Times, 12 December 2023.

8 Solid US job growth, drop in unemployment rate underscore labor market resilience, Reuters, 8 December 2023.

9 ECB resists rate cut bets with pledge to stay tight, Reuters, 14 December 2023.

10 Macroeconomic projections, December 2023, ecb.europa.eu.

11 UK recession might be under way after economy shrinks in Q3, Reuters, 22 December 2023.

12 Bank of England rebuffs rate cut talk after Fed ignites markets, Reuters, 14 December 2023.

13 Japan strives to control debt in face of rising rates, Reuters, 22 December 2023.

14 BOJ keeps ultra-loose policy, offers few hints on exit timing, Reuters, 19 December 2023.

15 IMF upgrades China’s 2023, 2024 GDP growth forecasts, Reuters, 7 November 2023.

16 China December factory contraction deepens, more stimulus on the cards, Reuters, 1 January 2024.

All data is sourced from FactSet unless otherwise stated. All references to dollars are US dollars unless otherwise stated.

These opinions should not be construed as investment or other advice and are subject to change. This document is for information purposes only. This is not investment research or a research recommendation for regulatory purposes. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell investments in those securities, countries or sectors. Issued in the UK by Newton Investment Management Limited, The Bank of New York Mellon Centre, 160 Queen Victoria Street, London, EC4V 4LA. Registered in England No. 01371973. Newton Investment Management Limited is authorised and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN and is a subsidiary of The Bank of New York Mellon Corporation. This material may be distributed by BNY Mellon Investment Management EMEA (BNYM IM EMEA) in the UK to professional investors. BNYM IM EMEA, BNY Mellon Centre, 160 Queen Victoria Street, London EC4V 4LA. Registered in England No. 1118580. ‘Newton’ and/or ‘Newton Investment Management’ is a corporate brand which refers to the following group of affiliated companies: Newton Investment Management Limited (NIM), Newton Investment Management North America LLC (NIMNA) and Newton Investment Management Japan Limited (NIMJ). NIMNA was established in 2021 and NIMJ was established in March 2023. This material is for Australian wholesale clients only and is not intended for distribution to, nor should it be relied upon by, retail clients. This information has not been prepared to take into account the investment objectives, financial objectives or particular needs of any particular person. Before making an investment decision you should carefully consider, with or without the assistance of a financial adviser, whether such an investment strategy is appropriate in light of your particular investment needs, objectives and financial circumstances. Newton Investment Management Limited is exempt from the requirement to hold an Australian financial services licence in respect of the financial services it provides to wholesale clients in Australia and is authorised and regulated by the Financial Conduct Authority of the UK under UK laws, which differ from Australian laws. Newton Investment Management Limited (Newton) is authorised and regulated in the UK by the Financial Conduct Authority (FCA), 12 Endeavour Square, London, E20 1JN. Newton is providing financial services to wholesale clients in Australia in reliance on ASIC Corporations (Repeal and Transitional) Instrument 2016/396, a copy of which is on the website of the Australian Securities and Investments Commission, www. asic.gov.au. The instrument exempts entities that are authorised and regulated in the UK by the FCA, such as Newton, from the need to hold an Australian financial services license under the Corporations Act 2001 for certain financial services provided to Australian wholesale clients on certain conditions. Financial services provided by Newton are regulated by the FCA under the laws and regulatory requirements of the United Kingdom, which are different to the laws applying in Australia. MAR005705.